As humans, we all can agree on a few things: water and food are essential, getting enough sleep is important, and taxes suck. I have never met one person that enjoyed paying taxes. Who would? As a CPA, my job is to legally minimize the amount of taxes my clients pay. Health Savings Accounts (HSAs) help me achieve that goal and they can help you too.

HSA Basics

An HSA is like any other savings account. You can contribute money, earn interest, and make withdrawals. They are commonly administered through your employer and funded with deductions from your paycheck, but they don’t have to be. You can also setup an HSA at a bank and contribute money without going through an employer. What makes an HSA different from a traditional savings account is its tax benefits.

An HSA Combines the Benefits of a Traditional and Roth Retirement Account

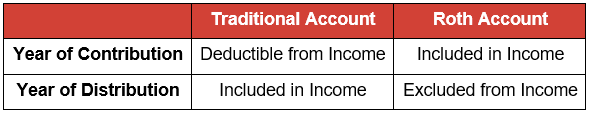

In the post, Should You Contribute to a Traditional or Roth Account?, we learned that the major difference between the two accounts is the timing of taxation.

The biggest factor in determining which account would be most advantageous is considering your current effective tax rate and what it may be in retirement. Because an HSA combines these advantages, you do not have to make this consideration. The choice is clear—you should contribute!

Traditional account contributions are deductible in the year of contribution, but included in your income when distributed. Roth accounts are taxed in the opposite direction. Contributions are included in your income in the year of contribution, but excluded from income when distributed.

HSAs have a triple tax advantage:

- Tax-deductible contributions <= Benefit of Traditional account

- Tax-free account growth <= Benefit of Traditional and Roth account

- Tax-free distributions (for qualified medical expenses) <= Benefit of Roth account

Why is this so amazing? Because as American citizens, we are subject to some particularly daunting tax laws. The U.S. Government taxes us no matter where we live in the world, when our student loan debt is forgiven, and sometimes even when we die!

“…nothing can be said to be certain, except death and taxes.” – Benjamin Franklin, 1789

The inescapability of the U.S. tax system makes it all the more amazing that the HSA exists. Triple tax benefits! Can you believe it!? I’m excited and I hope you are too. Congress created something where at least some of our money can literally escape taxation.

Which Medical Expenses Qualify?

To achieve the triple tax benefit, HSA distributions must be used for qualified medical expenses (which can also include dental and vision expenses).

A list of common qualified (and non-qualified) expenses can be found here, and include contacts, eyeglasses, birth control, Lasik, lactation equipment, smoking cessation programs, and health-related home improvements. Check out the list and learn where you could save!

tpattersonart.com

Distributions from an HSA for non-qualified expenses may be subject to taxation and a 20% penalty. Be wary of using your HSA for non-qualified expenses because the penalty could negate all benefits.

Most HSAs come with a debit card to make using the account easy. If you try to use the card for non-qualified expense, it may be rejected, helping you avoid any unintentional penalties.

Who is Eligible for an HSA

HSAs are only available for people enrolled in High-Deductible Health Plans (HDHP). As the name implies, a HDHP is a health insurance plan that includes a high deductible (and conversely lower premiums).

Deductibles are the amount you pay for medical services before the insurance company picks up the rest of the tab. Premiums are the amount you pay each month for insurance coverage. When you choose a health insurance plan, you are choosing between paying more each month for insurance (premiums) or paying more when you visit the doctor (deductibles).

There are many reasons you may not be enrolled in a HDHP. If you still want to benefit from a tax-advantaged medical savings account don’t worry! At the end of the post I discuss medical Flexible Spending Accounts (FSAs), which offer many of the same benefits as HSAs. Keep reading!

HSAs were created in an attempt to reduce the overall cost of health care. The idea is to incentivize people to choose insurance plans with higher deductibles. Higher deductibles deter people from going to the doctor for a minor illness, which frees up medical resources, and drives down overall costs.

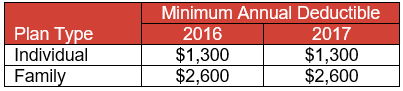

So what deductible level qualifies as “high?” The amount is adjusted annually and differs for individual and family plans.

Minimum Deductible for a HDHP

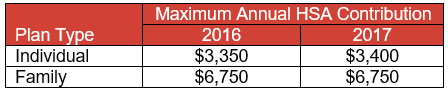

HSA Contribution Limits

Because HSAs have such great tax advantages, annual contributions have tight limits.

Maximum Annual HSA Contributions

Employer Contributions

HSA contributions are reported annually on your tax return as a deduction from income. If you mistakenly contribute more than the annual limit, the excess will not be tax deductible. In fact, excess contributions should be removed from your HSA immediately because they will incur a 6% penalty for each year they remain in the account.

Employers that offer health insurance may pay a portion of their employees’ insurance premiums. These employers often encourage employee enrollment in HDHPs due to the lower premiums (and therefore a lower cost to the employer).

This encouragement most often comes in the form of an HSA contribution. If you are considering switching to a HDHP it would be wise to take advantage of the free money. However, you must factor it into your annual HSA contribution limit. The limit is for total employer and employee contributions.

What if my employer doesn’t offer an HSA? The great thing about HSAs is that they are not tied to your employer. As long as you are enrolled in a HDHP, you can setup an HSA at a bank.

Deductible Medical Expenses and HSAs

Medical expenses are tax deductible on Schedule A on your income tax return. However, if you use an HSA to pay for qualified medical expenses, you cannot also include them as a medical deduction on your Schedule A. So which tax advantage is more beneficial?

When it comes to qualified medical expenses, using an HSA is more advantageous than a Schedule A deduction. Deductible medical expenses must exceed a certain dollar value, based on your age and Adjusted Gross Income (AGI), before they begin providing a tax benefit. HSA contributions are 100% deductible, even if immediately distributed for qualified medical expenses.

The Basic HSA Strategy

When determining how much to contribute, calculate the total amount you plan to spend on qualified expenses during the year and set that as your minimum HSA contribution. Someone with qualified annual expenses of $2,000 and an effective tax rate of 25%, would save $500 simply by routing the transactions through their HSA.

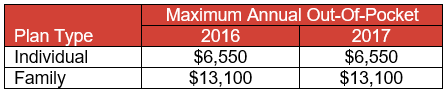

The next step towards maximizing the use of your HSA is to incorporate it into your emergency savings. This involves contributing a sufficient amount to maintain a minimum balance equal to your annual out-of-pocket maximum plus any qualified annual expenses.

HDHP Maximum Annual Out-Of-Pocket

Maintaining an HSA balance above your annual out-of-pocket maximum prepares you for unexpected medical expenses in a tax-savvy way. This strategy ensures that you’ll be able to benefit by fully deducting all of your medical expenses, even when they are unexpectedly high.

The annual out-of-pocket maximum is the most you will have to pay in one year for medical expenses, before any additional costs are 100% covered by the insurance company. As you can see, these amounts are higher than the maximum annual HSA contribution limits.

Medical Flexible Spending Accounts (FSAs)

No conversation about HSAs would be complete without discussing Flexible Spending Accounts (FSAs). FSAs can be used for a variety of expenses, but here we’ll just focus on one type: medical FSAs. This is the most comparable alternative if you are ineligible for an HSA.

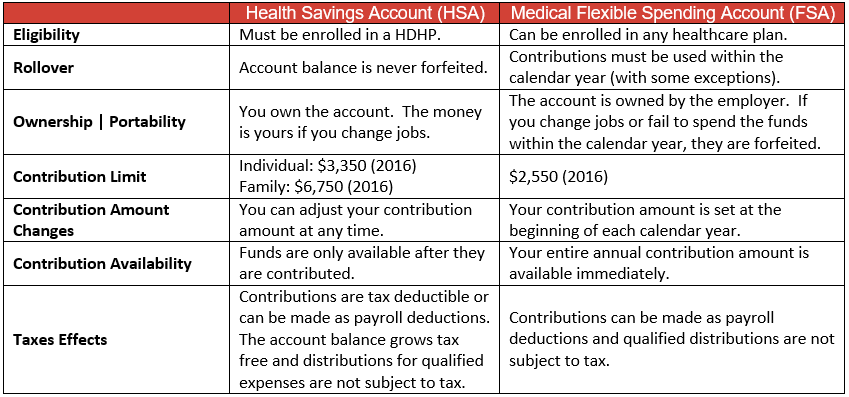

Differences Between an HSA and a Medical FSA

When to Use an FSA

There are reasons not to be enrolled in a HDHP (a topic for another day!). If you are not enrolled in a HDHP, you may be eligible for a medical FSA. The differences between an HSA and a medical FSA are summarized above, but I’d like to highlight a few things:

- Money contributed to a medical FSA is use-it-or-lose-it each year! Do not contribute more than you will absolutely spend in a given plan year.

- Money contributed to a medical FSA cannot be rolled over if you leave your employer! If you are leaving your job, you should spend up to the planned annual contribution (not just the amount contributed so far) before you leave.

- Medical FSAs must be employer-sponsored! If you are not working or your employer doesn’t offer one, you cannot set one up at the bank.

Conclusion

For those enrolled in a HDHP, the triple tax benefit (tax-deductible contributions, tax-free growth, and tax-free distributions) of an HSA makes contributions a no-brainer. If you buy glasses, contacts, prescription drugs, or any other qualified medical expenses during the year, you should be taking advantage of an HSA. If you are not enrolled in a HDHP, you should opt for a medical FSA (assuming your employer offers it).

To determine how much to contribute, start by calculating the amount you spend annually on qualified medical, dental, and vision expenses. Then use the HSA-provided debit card on those expenses. That’s it! You’re saving money by making pre-tax purchases.

Are you interested in getting one-on-one personalized advice on how to maximize your HSA? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.