Just about everyone I know took out student loans, and most are still paying them off today. Nationwide, the number of people with student loan debt is just over 43 million and around 70% of college graduates finance their education with loans. The rising cost of education coupled with the increasing necessity of a college education has made student loan debt almost inescapable.

Student loans are a complex government-sponsored program, subject to the ebbs and flows of Washington. In fact, your loans may be named after a former Senator from Vermont (Stafford) as recognition for his work on higher education or maybe a Democratic Congressman from Kentucky (Perkins) who fought for equal education of the less fortunate. Student loans can be federal or private, subsidized or unsubsidized, for undergraduate or graduate school, and have a myriad of repayment options (e.g., consolidation, deferment, forbearance, forgiveness, income-based repayment, graduated, extended, pay as you earn, revised pay as you earn, income contingent repayment, income sensitive repayment). For many people, choosing the right plan and repayment strategy could mean the difference between tens of thousands of dollars over the life of the loan.

If you have student loans, you have surely been given advice on how to manage them from friends or family. “Oh, you should refinance your loans and get a lower interest rate!” or “An income-based repayment plan will help you lower your payments!” However, when it comes to personal finances, a one-size-fits-all solution does not exist. That’s why it’s personal! Deciding the best action to take always depends on at least a handful of considerations. For example, lowering your interest rate may sound good, but if you refinance your federal loans with a private company, you could lose out on forbearance or deferment options. Similarly, starting a loan forgiveness program undoubtedly sounds attractive, but may cost you more over the life of the loan when you factor in the income tax effects.

Whether you decide to work with an advisor, use a web-based analysis program, or tackle your student loan strategy on your own, you’ll need to start by gathering the necessary details about your loan. So what’s important?

Are Your Student Loans…

Federal Or Private? Simply stated, federal loans are funded by the government, whereas private loans are issued by banks and other financial institutions. (If you remember completing a FAFSA you likely have at least some federal loans.) The differences between the two types of loans are significant. Private loans often have higher interest rates, may require payments while in school, and rarely offer income-based repayment or forgiveness. Be wary of refinancing your federal and private loans together. You may be offered a better interest rate, but at the expense of your ability to take advantage of special repayment and forgiveness options. The forfeiture of these options should be considered in detail before deciding that refinancing with a private institution is the right path for your federal loans.

If you have determined that your student loans are federal, there is a whole host of other questions to answer. Each type of loan will have an effect on the repayment options available to you.

Are Your Federal Student Loans…

Subsidized Or Unsubsidized? Subsidized loans are more advantageous than unsubsidized because the U.S. Department of Education pays the interest expense while the borrower is in school, for the first 6 months after they leave school, and during periods of deferment. This can result in a lower overall loan balance after graduation. The subsidized or unsubsidized nature of your loans should be considered when analyzing different repayment plans. Income-based repayment plans may be more favorable for subsidized loans because the interest payment may not be capitalized into the cost of the loan for the first three years.

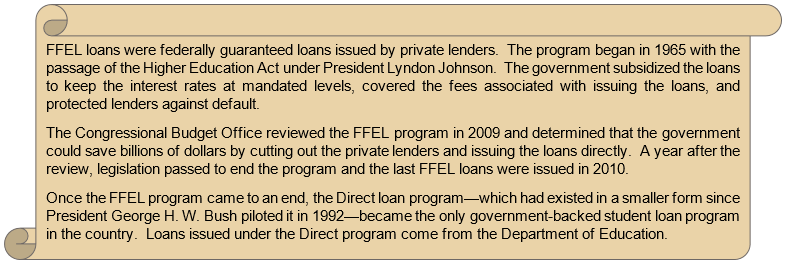

Were They Issued Before 2010? The year in which your student loans were issued can affect the payment options available as well as the interest rate. For this reason, you should determine the date of issuance or disbursement of your loans. This quirk of student loans is due to the legislative history of the government-sponsored program. Before the passage of the Health Care and Education Reconciliation Act of 2010, two types of student loans were offered: Federal Family Education Loans (FFEL) and Direct loans. Although there is no difference in the cost for these two types of loans, repayment options are not the same for both. Whether your loans were issued prior to 2010 or not, it is important for you to be aware of which type of loans you have to determine the necessary steps for repayment or consolidation.

A Brief History: Student Loan Programs

Grad Plus Loans? Direct loans only offer coverage up to $20,500 of graduate-level expenses per year. So, if you took out student loans to cover the cost of graduate-level studies (often more expensive than the Direct loan limit), some of them may be Grad Plus loans. These loans are similar to loans under the Direct program, but require a credit check at the time of application. As with other loans types, it is important to know what you have before you can determine the necessary steps for repayment or consolidation.

Parent Plus Loans? If a parent or guardian took out student loans in his or her name to help you pay for the cost of undergraduate or graduate education, then he or she is responsible for repayment of the loan and cannot legally transfer this responsibility to you as the child. You may have the desire to assist in the repayment of these loans, but it is important to recognize that they generally cannot be consolidated with loans that are in your name. They are also subject to different repayment options and it may be best to avoid consolidating them with other loan types.

Perkins Loans? Perkins loans are for students that have a high level of financial need. These loans have a lower interest rate than Direct or FFEL loans (which are both Stafford loans), but are subject to the needs of the student and the availability at the student’s college or university. As with all the various types of loans discussed, Perkins Loans are subject to different repayment options as other types of federal loans.

The Bottom Line

Ok, you got it. Student loans are complex (and you probably didn’t need me to tell you that). But now what should you do to ensure you are paying them off in the most efficient manner? First—get organized! Beyond determining the type of student loans you have (using the information above), you’ll need to know many other specifics before you can seek professional help or create a strategy on your own. Specifically, you will need to know the status (e.g., deferment, forbearance, current), interest rate, monthly payment, principal balance, and repayment period. If you have private loans, you will also want to know the name of your lender or servicer (which you can get through a credit report). Whether you think you know the answers to these questions or not, start by getting organized.

Organizing Federal Student Loans

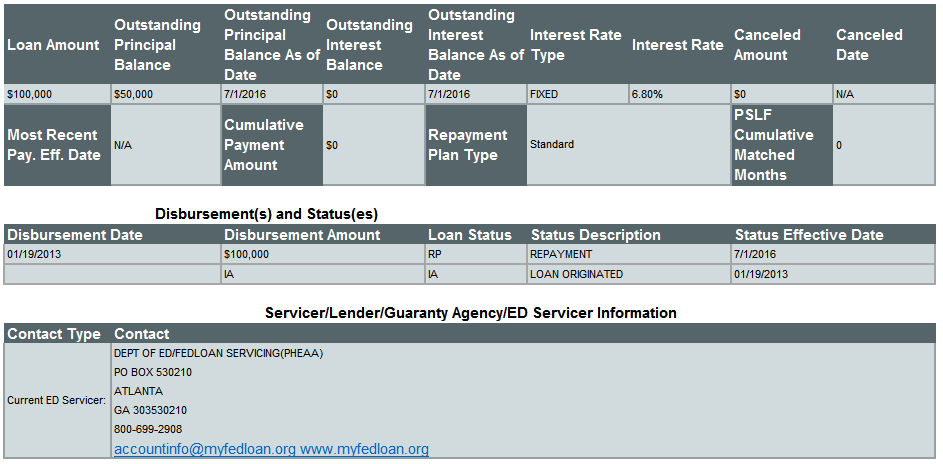

You can obtain all the information you need about your federal loans in one place by setting up an account at the National Student Loan Data System (NSLDS; www.NSLDS.ed.gov). If you are new to the system, click “Financial Aid Review” to set up your account. Once set up, you will be able to view a summary of your federal student loans on the main page. For additional detail about an individual loan, click on the blue numbers to the left of the summary. Your detailed summary should look similar to the image below. It shows the original loan amount, disbursement date, outstanding principal and interest balances, interest rate, repayment plan type, current status, and progress towards Public Service Loan Forgiveness (PSLF).

All of this is important information to consider so that you can begin to analyze which repayment programs or forgiveness options may be best for you. Once your NSLDS account is set up, take a screenshot of each loan to share with your financial planner or consolidate all the information into a spreadsheet for reference. It is easy to highlight, copy, and paste the information from NSLDS directly into an Excel workbook.

Organizing Private Student Loans

The easiest way to make sure you are accounting for all of your loans is to check your personal credit report. You can do this a few different ways:

- www.annualcreditreport.com, the government-sponsored resource that provides you with a free copy of each of your three credit reports annually (yes, you have three from three different agencies). Be careful to go to exactly this website!! There are many similar sites out there which are not free, will spam you to death, and misuse your personal information.

- Credit monitoring websites, such as www.CreditKarma.com. I use Credit Karma to monitor my credit scores on an ongoing basis. It’s very easy to set up and intuitive to use.

- Through your credit card, if available. Many credit card providers (e.g., Discover, USAA) have begun to offer access to your credit report as an included bonus. Log in to your credit card account page and look for a link to your credit report.

- As part of your identity theft protection, if applicable. A very small silver lining to some of the recent hacks to our personal information is that many of us have received free identity theft protection. For example, Target, Home Depot, and the Office of Personnel Management have offered free identify theft protection to affected individuals, which often includes free ongoing access to your credit report.

Your credit report will list each credit card and loan associated with your Social Security number. Review the list for private student loans to ensure you are aware of your loan balance(s) and the loan servicer(s). Each servicer likely has an online portal where you can set up an account and view the status and terms of your loans online. After setting up an account for each private loan, add this information to your student loan spreadsheet. Include the interest rate, disbursement date, repayment period, current status, payment history, and any other available information.

Next Steps

With your student loan information consolidated in one location, you will be prepared to make choices to change your repayment schedule, refinance, consolidate, or seek loan forgiveness. Subscribe to receive notification when my future blog posts for the Take Control of Your Student Loans series are available, and get updates directly to your inbox.

Ready for some one-on-one advice on how to take control of your student loans? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your student loan questions.