Do you have student loans? Ever wondered what options are available for reducing your monthly payment or having your loans forgiven? In the first blog post of the series “Take Control of Your Student Loans” we discussed the importance of Understanding Your Student Loans. This post we’ll go a little further and discuss how repayment plans can reduce your monthly payment, help you manage your cash flow, and even lead to the holy grail—student loan forgiveness.

tpattersonart.com

tpattersonart.com

Student Loan Repayment Plan Scenario

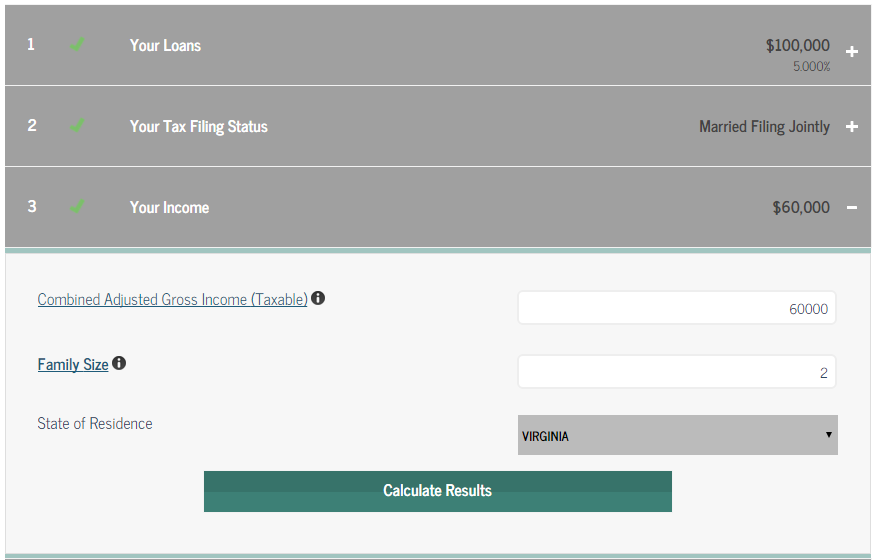

The U.S. Department of Education offers a repayment estimator to help us explore our options. Click the link and you’ll arrive on a landing page that prompts you to login to access your actual loan data or input the information manually. (You can login with the same National Student Loan Data System account discussed in the Understanding Your Student Loans post).

To help us discuss the differences between the repayment options I have entered the following scenario manually, but I encourage you to sign in and follow along with your actual loan data.

- Loan Type: Direct Unsubsidized

- Balance: $100,000

- Interest Rate: 5%

- Tax Filing Status: Married Filing Jointly

- Spouse’s Loans: None

- Combined Adjusted Gross Income (AGI): $60,000*

- Family Size: 2*

- State of Residence: Virginia

*Note: The estimator assumes that family size will remain the same throughout the repayment period and that income will grow at 5% annually. Family size includes you, your spouse, and any other individuals in your household for which you provide more than 50% of their support (including children).

My input looks like this:

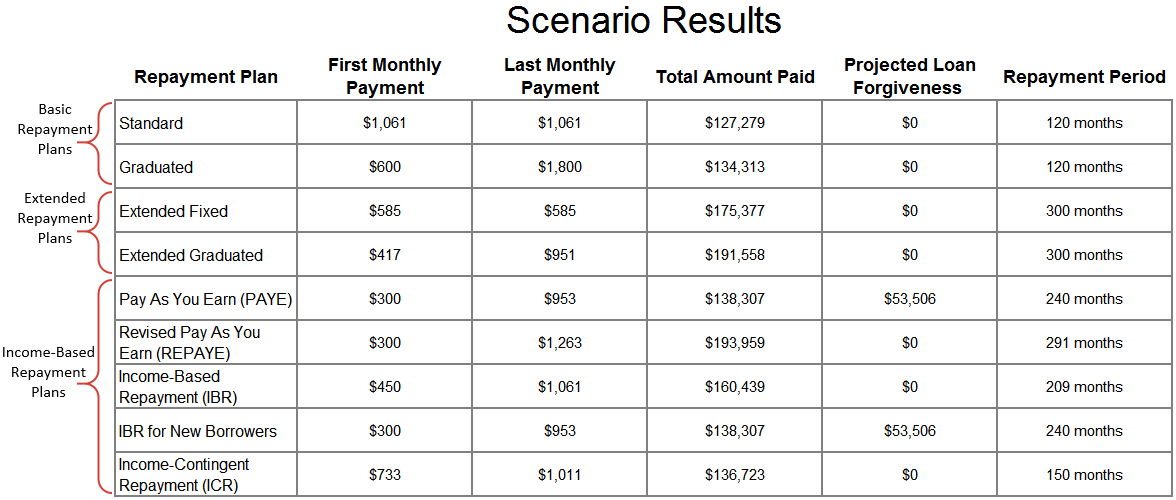

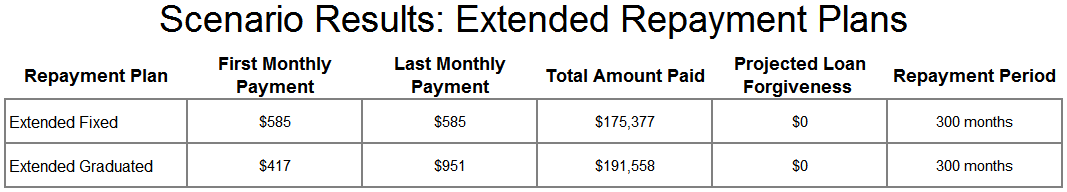

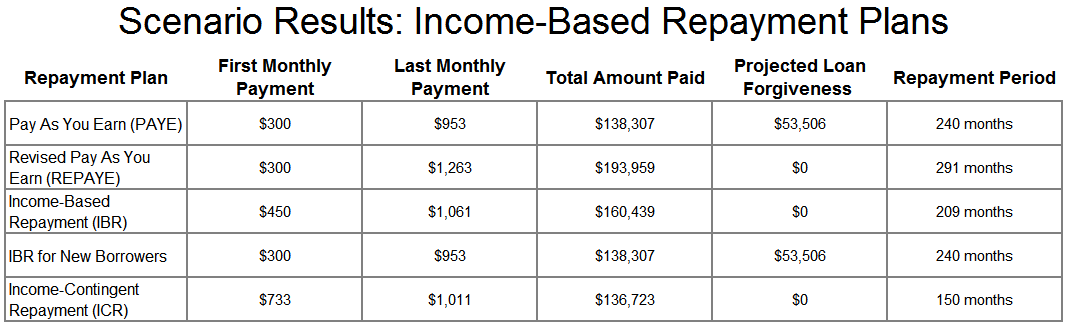

Here are the results of the scenario above, which I’ll explain in detail in the following sections.

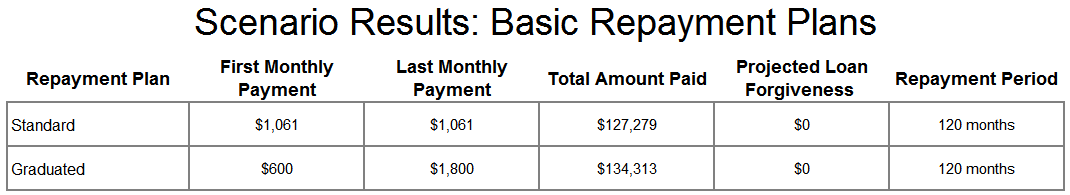

Basic Student Loan Repayment Plans

The first category is basic repayment plans and consists of two options. Both have a 10-year repayment period and are available for all federal loan types:

- Direct and Stafford Loans (Federal Family Education Loans)

- Unsubsidized and Subsidized

- Grad and Parent Plus Loans

- Consolidated Loans

Standard Student Loan Repayment Plan

The standard repayment plan is the most basic repayment option, and the one you’ll automatically be enrolled in after graduation if you take no action to adjust your repayment plan. In the scenario, I borrowed $100,000 and as calculated in the table above, will pay a total of $127,279 ($27,279 of which is interest expense) over the life of the loan. The standard plan breaks the repayment into 120 equal monthly payments ($1,061) each with a portion going to interest and a portion to principal. (For a detailed review of loan structuring, amortization tables and loan capitalization refer to the “Play | Pause” box in the Understanding Your Student Loans post.)

Although this repayment option has higher monthly payments than the required amount of other options, it is the least expensive over the life of the loan (as indicated by the value in the “Total Amount Paid” column). This occurs because the standard plan pays off the most principal in early years, and has the shortest repayment period (120 months). In other words, it carries the smallest balance upon which interest must be paid, and lasts the shortest period of time.

When should you use a standard student loan repayment plan? If you anticipate being able to make your monthly payments without creating financial hardship, it could be the best option for you because it is the least expensive (smallest total interest expense over the life of the loan). If you make all of your scheduled monthly payments, the loan will be repaid in 10 years at the lowest cost to you.

Graduated Student Loan Repayment Plan

The graduated repayment plan is a slight variation of the standard repayment plan. It is also a 10-year (120 month) repayment period, however the monthly payments are not fixed throughout the life of the loan. The plan adjusts payments down in the earlier years (the lower bound is the monthly interest expense) and up over the later years to more aggressively pay off principal. The adjustments take place every two years based on the borrower’s current income, the interest rate, and the loan balance.

Under the graduated plan in the scenario, my monthly payment is much lower than the standard plan at first ($600 versus $1,061), but will rise all the way to $1,800 per month in the final years of repayment. With lower initial monthly payments, I will pay off less principal in the early years of the loan. This causes the overall cost of the loan to be higher because more interest is charged against the higher principal balance. My $100,000 loan ends up costing $134,313 under a graduated repayment plan (26% higher interest expense than the standard repayment plan).

When should you use a graduated student loan repayment plan? Despite the higher interest expense compared to the standard repayment plan, the graduated repayment option could be advantageous for some borrowers. If you need to reduce your initial monthly payments down to a more manageable level, but expect above average income growth over the next 10 years (allowing you to make much larger payments in the later years), the graduated repayment plan may be the way to go.

Extended Student Loan Repayment Plans

The next category of plans is extended repayment, and consists of two options. Both options have a 25-year repayment period and are available for all federal loan types for borrowers with an outstanding balance of $30,000 or more.

Extended Fixed Student Loan Repayment Plan

An extended fixed repayment plan is similar to the standard repayment plan (equal monthly payments), except the loan repayment is stretched out over 25 years instead of 10. The downside to this option is that because the monthly payments are smaller and the length of the loan is longer, the interest expense over the life of the loan is significantly higher than under standard repayment.

In the scenario, the interest expense under an extended fixed repayment plan totaled $75,377, which is 176% higher than the interest expense for the standard repayment plan.

When should you use an extended fixed student loan repayment plan? This repayment plan option could make sense if you cannot make the monthly payments under the standard repayment plan and do not expect your income to grow fast enough to the point where a graduated repayment plan would be doable.

Extended Graduated Student Loan Repayment Plan

The extended graduated repayment plan is a mix between the graduated and extended repayment plans. The repayment period is 25 years (like extended) and the monthly payments increase through the life of the loan (like graduated). For this option, the monthly payments are even smaller than the graduated plan in the beginning, and the length of the loan is longer, which causes the interest expense over the life of the loan to increase significantly.

In the scenario, the interest expense under an extended graduated repayment plan totaled $91,558 (almost doubling the original loan), which is 236% higher than the interest expense under the standard repayment plan.

When should you use an extended graduated student loan repayment plan? This repayment plan option could make sense if you cannot make the monthly payments under the extended repayment plan or the graduated repayment plan, you expect your income to grow over time, but cannot benefit from an income-based repayment plan (discussed next).

Income-Based Student Loan Repayment Plans

The last category of plans is income-based repayment, and consists of four options (one of which varies based on when the loans were disbursed). The repayment period for income-based repayment plans depends on the plan type and the borrower’s loan balance and income.

Pay As You Earn (PAYE) Student Loan Repayment Plan

This type of plan is only available to new borrowers who received a Direct loan disbursement on or after October 1, 2011, and is not available for Stafford (FFEL) or Parent Plus loans.

The PAYE repayment plan caps your student loan payment at 10% of your monthly discretionary income. To determine your monthly discretionary income, take the difference between your income and 150% of the federal poverty level for your family size and state of residence (annual discretionary income) and divide by 12. In the scenario, a family of two with residence in the state of Virginia and an AGI of $60,000 has a monthly discretionary income of $2,997.50:

| [AGI of $60,000 – (federal poverty level of $16,020 × 150%)] | = $2,997.50 |

| 12 |

This means that monthly payments will be capped at $299.75 (10% of monthly discretionary income), or ~$300, as shown in the chart above. PAYE repayment plans have a 20-year repayment period, after which any remaining balance on the loans is forgiven. The monthly payments will increase as the borrower’s income grows, but will never be higher than the amount required under a standard repayment plan ($1,061 in the scenario).

It is important to realize that although any remaining balance on the loans is forgiven after the 20-year repayment period, this is a taxable event for the borrower. As crazy as it sounds, you are required to include debts that are forgiven as income in the year of forgiveness on your tax return. In the scenario, the estimator calculated that $53,506 of student loans would be forgiven under the PAYE repayment plan. If the borrower’s effective tax rate is 25%, this means they’ll owe an additional $13,377 in taxes when the remaining loan balance is forgiven. That is a lot less than the $53,506 owed, but still a significant amount of money. If you are on an income-based repayment plan, be aware of the tax consequences of loan forgiveness and make sure you plan accordingly by setting aside funds to pay your tax bill.

When should you use a PAYE student loan repayment plan? PAYE may be advantageous if you have Direct loans and low income compared to your level of debt.

Revised Pay As You Earn (REPAYE) Student Loan Repayment Plan

This plan is available for borrowers with Direct loans (regardless of when they were disbursed), but is not available for Stafford (FFEL) or Parent Plus loans.

The REPAYE plan is similar to the PAYE plan, with three main differences:

- Increased eligibility: All borrowers with Direct loans (except Direct Parent Plus loans) are eligible.

- Various repayment periods: For undergraduate loans the REPAYE plan has the same 20-year repayment term as the PAYE plan, but for graduate or professional studies the repayment term extends to 25 years.

- No upper limit on monthly payments: Under the REPAYE plan, the monthly payment is based on the borrower’s monthly discretionary income. However, unlike PAYE, if discretionary income reaches a certain level, the monthly payment can be higher than the amount required under a standard repayment plan ($1,061 in the scenario).

In the scenario, the estimator assumes that income is growing by 5% annually. This assumption causes discretionary income to grow to the point where the required monthly payment equals $1,194.

When should you use a REPAYE student loan repayment plan? If you have low income compared to your level of debt and Direct loans that were distributed before October 1, 2011.

Income-Based Student Loan Repayment (IBR) Plan

This plan is available for borrowers with Direct and Stafford loans (regardless of when they were disbursed), but not Parent Plus loans.

The IBR plan, like all other repayment plans of this type, caps monthly payments at a percentage of discretionary income. However, the cap and length of the loan vary based on when the student loans were issued.

- For new borrowers (see below) the repayment amount is capped at 10% of discretionary income and the repayment period is 20 years.

- For non-new borrowers the cap is 15% and the repayment period is 25 years.

A new borrower is defined as “someone who has no outstanding balance on a Direct Loan or Federal Family Education Loan (FFEL) Program loan when he or she receives a Direct Loan or FFEL Program loan on or after July 1, 2014.”

For both new and non-new borrowers under IBR, any outstanding balance is forgiven at the end of the repayment period and included as taxable income. As with the PAYE plan, the monthly payment will never be higher than the amount required under a standard repayment plan ($1,061 in the scenario).

When should you use an IBR plan? If you have Stafford (FFEL) loans and low income compared to your debt level.

Income-Contingent Student Loan Repayment (ICR) Plan

Available for all federal loan types (although some must be consolidated first), including Parent Plus loans.

ICR plans have the largest monthly payment cap (20% of discretionary income) and the longest repayment period (25 years) of the income-based repayment plans. Although it is the least advantageous in terms of reducing the required monthly payment, it is the only income-based repayment plan available for Parent Plus loans (or consolidated loans that include Parent Plus loans). As with the other income-based repayment plans, any outstanding balance at the end of the repayment period will be forgiven and included in the borrower’s taxable income.

Although ICR plans do not reduce the borrower’s required monthly payment to the same degree as other income-based repayment plans, this ends up being an advantage in terms of overall cost of the loan. In the scenario, because the ICR plan capped the monthly payments at 20% of discretionary income (as opposed to 10%) the loan is paid off over a shorter period of time than is required by the plan, and produces one of the lowest overall “total amount paid” figures of all the repayment plans.

When should you use an ICR plan? If you have Parent Plus loans and would like to participate in an income-based repayment plan, ICR is the only income-based repayment plan available.

Conclusion

Electing one of the repayment plans discussed above may help you increase your current cash flow, help you avoid default, or even lead to student loan forgiveness. Not all plans are available for all student loans, so it is important to understand the loans you hold. Only then can you weight the pros and cons, consider your current needs, and make an educated decision. Use this post, and the tools discussed above, to start a conversation with your financial planner and take control of your student loans.

Ready for some one-on-one advice on how to take control of your student loans? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your student loan questions.