UK Remittance Basis taxation allows non-domiciled residents to exclude foreign source (non-UK) income and gains from UK taxation. If you’re an American with any amount of UK income, continue reading to understand how you will be taxed.

(Read UK Estate Tax and Gifting to learn about estate taxes and gifting rules for Americans living in the UK at the time of death.)

I’m an American moving to the UK, how will I be taxed?

In general, an American with income in the UK will be taxed under one of three different systems depending on their status: non-resident, resident, or non-domiciled resident. This article will focus mainly on the third status—non-domiciled resident (remittance basis of taxation)—but first let’s touch on the other two.

What is non-resident taxation in the UK?

Non-resident taxation is the system for individuals that have UK source income, but do not physically reside in the UK. For example, an American that travels to the UK for a speaking engagement or book tour, but will return to their residence outside the country once their short-term work is complete. Or maybe they are never physically present in the UK, but own a rental property in London that is generating income.

What is resident (a.k.a. arising basis) taxation in the UK?

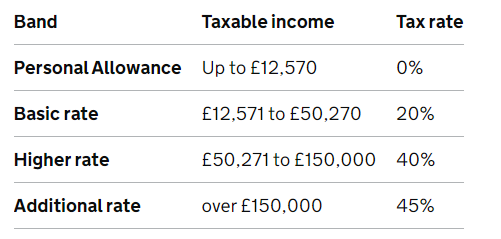

An individual that is a resident and domiciled (more on this below) in the UK is subject to taxation on their worldwide income under the standard, arising basis system. The arising basis system is not covered comprehensively in this post, but it is similar to the US system with progressive tax brackets, exemptions, and preferential rates for some types of income like dividends and capital gains. I’ve included the tax brackets below.

What is non-domiciled resident (a.k.a. remittance basis) taxation in the UK?

Many countries tax their residents’ worldwide income, no matter where it is sourced. However, the UK offers an appealing tax system to non-domiciled residents that allows them to exclude foreign source (non-UK) income and gains from UK taxation.

For qualifying Americans this could mean that your US rental, dividend, interest, and capital gains income could be excluded from UK taxation.

How do I know if I’m resident or domiciled in the UK?

Residence is based on physical presence or employment in the UK over a tax year. If you worked full-time in the UK for at least one tax day during the tax year, you’re a tax resident.

You can also become a tax resident by spending 183 or more days in the UK or having your only home located in the UK.

Domicile usually happens one of three different ways:

- Origin: You’re a UK citizen and the UK is the location of your permanent home.

- Choice: You decide that the UK is the location of your permanent residence.

- Time: You’ve been a UK tax resident for at least 15 out of the last 20 years.

What are the advantages and disadvantages of remittance basis of taxation in the UK?

Advantages: Wages, interest, dividends, business income, and other types of income earned outside of the UK would not be subject to taxation in the UK as long as the income isn’t remitted to the UK (i.e., transferred to the UK for spending; more on this in a moment).

Another big advantage (over domiciled residents) is that non-domiciled residents are not subject to inheritance tax in the UK on non-UK assets. This is extremely appealing because the UK has a much lower exemption of £325,000 before the estate tax applies (lower compared to the US where the exclusion is almost $13M per person). This means that when a non-domiciled resident passes away, no UK estate tax would be owed on any non-UK assets. In contrast, domiciled residents would pay estate tax on their assets exceeding £325,000 (about $403,000) at a rate of 40%.

Disadvantages: One major disadvantage is that after the first seven years of electing remittance basis of taxation in the UK, individuals must pay a remittance basis charge annually. The charge ranges from £30,000 up to £60,000 depending on the number of years they have been a tax resident. This charge can easily flip the equation and exceed any benefit from excluding your foreign source income from UK taxation. Therefore, electing remittance basis of taxation may only make sense for the first seven years of UK residence, but not after unless there is substantial non-UK income.

A second, but less important disadvantage is that individuals that elect remittance basis of taxation are not allowed to take a personal allowance (£12,570) or an annual exemption from capital gains tax (£12,300) on their tax return. They are subject to the same rates and brackets as domiciled residents under arising basis taxation, but do not benefit from these two basic deductions. Admittedly though, this isn’t such a big deal. The personal allowance starts phasing out on incomes above £100,000 and is completely gone by £125,140 in wages. (So if you make more than that, the deductions wouldn’t apply to you anyway.)

What does it mean to remit funds to the UK?

Remit has a broad definition. It means to transfer, move, trade, or spend funds or assets in the UK financial system or economy for the benefit of a relevant person (defined below). This includes transferring funds to buy a house, pay rent, meet your living expenses, obtain services, or just about anything else with a few exceptions. You can remit funds to the UK without incurring additional tax as long as the funds are clean capital (discussed below) and not foreign source income earned after you became a UK resident. This means that proper planning, segregation of funds, and record keeping are extremely important tax minimization tools.

Relevant person: You need to take care not to remit funds to the UK for your benefit, but also for the benefit of “relevant people”. This includes your spouse, kids, grandchildren, trust beneficiaries, or companies.

Clean vs. mixed capital: Clean capital is funds that can be remitted to the UK without increasing your UK taxable income. This includes UK source income as well as foreign income, gains, and assets that were accumulated or earned before you became a UK tax resident. Basically, your entire net worth is clean until it isn’t…

Capital becomes “dirty” (a.k.a. mixed) once additional income, interest, dividends, or gains accumulate in an account after you become a UK tax resident. Any bank account, investment account, or other asset that has income paid into itself after you become a UK tax resident will immediately become “dirty” or mixed. Earn one penny of interest and the entire account is mixed.

If mixed funds are remitted to the UK they are subject to mixed-fund ordering rules with the least advantageous funds being remitted first before any clean funds.

How do I keep my capital clean?

Accurate record keeping and multiple bank accounts are key. Your UK source wages should be paid into one account and non-UK sourced wages into another. A third account should hold your clean capital in an offshore non-income producing account or an account with a competent institution that will pay the income into a different account. Capital gains and dividend producing accounts will never be clean and the proceeds should never be mixed with your clean capital account. However, you could have an account with capital loss investments because subjecting capital losses to UK taxation wouldn’t add to your tax liability.

What does remittance basis of taxation actually look like in practice for an American?

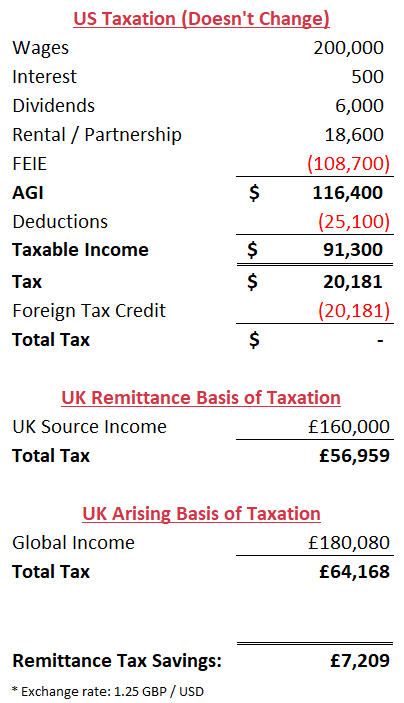

Let’s review a simple scenario where US source income adds up to less than the standard deduction. The taxpayer makes £160,000 ($200,000) in wages, as well as interest, dividends, and partnership income that all add up to $25,100 (the exact amount of the standard deduction in 2021 for a couple).

How does this look under remittance basis of taxation?

All of the wage income is offset by the FEIE and FTC, and because the remainder is under the standard deduction (or equal to it) there is zero US tax. The $25,100 of income is completely tax free in the US and the UK!

How does this compare to arising basis?

If they were taxed under the arising basis in the UK their taxable income would equal their global income, £180,080 ($225,100). Without going into the details of taxation of different types of income and exclusions in the UK, remittance basis of taxation could lead to a savings of £7,209 for this taxpayer because their UK taxable income is £20,080 lower.

There is an endless number of scenarios based on the amount and type of income for the taxpayer. Therefore, preparing a multi-year two country tax projection is necessary to determine the benefit from remittance basis of taxation.

Does this create any unique planning opportunities on the US side?

Absolutely! There is huge potential for recognizing US source capital gains to max out the 0% bracket (up to $83,350 for a married couple in 2023) and/or multi-year Roth conversions under the standard deduction amount. A dream scenario for any financial planner.

What is Overseas Workday Relief in the UK?

It is beyond the scope of this blog post, but further tax savings could come from pairing UK remittance basis of taxation with the Overseas Workday Relief program. If you travel for your UK-based job and spend a lot of time working outside of the country, you may be able to exclude that income from UK taxation as well.

Do you have questions about the remittance basis of taxation? Leave them in the comments below!

Resources and Tax Forms:

- UK HMRC Remittance Basis of Taxation Guide: https://www.gov.uk/

government/publications/ remittance-basis-hs264-self- assessment-helpsheet/ remittance-basis-2021-hs264 - UK HMRC Residence and Domicile Guide: https://www.gov.uk/

government/publications/ residence-domicile-and- remittance-basis-rules-uk-tax- liability - UK Arising Basis Tax Brackets: https://www.gov.uk/income-tax-rates