Our financial lives are a constant game of tug of war. Our desires pull us, and our money, in competing directions as we try to meet all of our financial priorities. “I want to buy a home, pay off my student loans, and pay for my wedding… oh yeah, and have kids and save for retirement”—sound familiar? All of this can feel overwhelming, but it doesn’t have to. We can take control by identifying our goals, prioritizing them, and setting up a realistic and thoughtful action plan.

tpattersonart.com

tpattersonart.com

3 Non-Negotiable Financial Priorities for Everyone

You have to walk before you can run. Before you can start savings for a house, a car, or an antique collection of cookie jars, you need to get your financial house in order. This means achieving three non-negotiable financial priorities first.

Priority #1: Build Your Emergency Savings

Having sufficient emergency savings should be your #1 financial priority. I know it’s not a very exciting goal, but it’s critical. Without an emergency savings, your hard work toward other goals could be wiped away in an instant by an unforeseen expense. You want to avoid scrambling for money and resorting to credit cards when you find yourself in a pinch.

“Sufficient” emergency savings typically equals six months of expenses. There’s no doubt that’s a big number, so break it into achievable steps. Start by saving an extra $100 here and there, until you have $1,000, then keep going. Use your budget to identify where you can sacrifice and make it a game to challenge yourself. For example, see if you can make all your meals at home for a month to save money.

Priority #2: Get the Match on Retirement Account Contributions

Many employers will match a portion of your retirement account contributions, and this is something you shouldn’t pass up! It may seem strange to prioritize saving for retirement above paying off credit card or student loan debt, but it is a mathematical question of returns. You’re looking for where your money will work the hardest for you. If your employer matches 100% of your retirement plan contribution, that’s a guaranteed 100% return before you even invest the money. In other words, contributing $100 to your retirement account will earn you another $100 from your employer. If instead you used that same $100 to pay off a credit card with an interest rate of 15% (the average), you would only save $15 in a year. Mathematically the choice is clear, $100 > $15.

Priority #3: Pay Off High Interest Debts

The third non-negotiable priority is to aggressively pay off high interest debts (e.g., credit cards, car loans, private student loans). High interest debt is simply a waste of financial resources, and the benefit of paying it off is again, a mathematical question of returns. It makes no sense to make risky investments (like stocks) hoping for a 6% return when you’re paying interest on credit card debt at a guaranteed loss of 15%. High interest debt has got to go! If you can’t pay your monthly credit card balances in full, stop using the cards. (Check out my post 11 Rules for Using Credit Cards Wisely to learn more). Once you’ve paid off your credit cards (which generally have the highest interest rate), look at the rates on your car and student loans. If the rate is higher than 6%, you may want to consider paying the debt off aggressively before investing to achieve other goals.

4 Steps to Manage Competing Financial Priorities

Once you have the non-negotiable priorities taken care of, the rest is up to you. Prioritizing your remaining financial goals can be a little tricky because it’s an extremely personal and subjective endeavor. To me, fashion isn’t a big concern, therefore I don’t spend much money on clothing. However, fashion may be extremely important to you and that’s great. You do you, and make building your wardrobe a top goal.

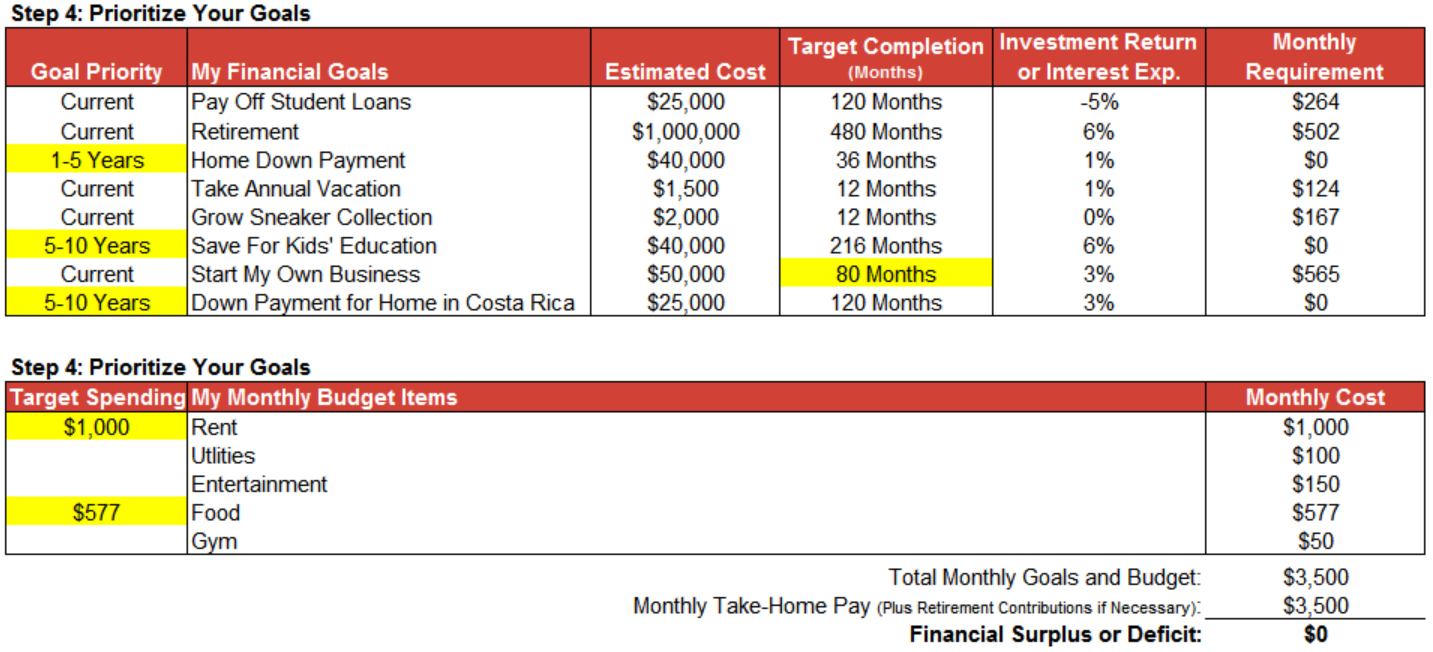

The following four steps are a guide to help you make these personal priority decisions and set realistic goals. Follow along by downloading this Excel financial priority matrix or reviewing the screenshots of the matrix throughout the post.

Step 1. Identify Your Goals

You have a 95% higher chance of achievement if you write down and review your goals regularly. Let’s start now, write this down: “I will write down and review my goals regularly.” Great! We are making progress already.

To identify your goals, begin with a brainstorming session. Write down all of your financial priorities—paying off student loans, saving for retirement, purchasing a home—whatever they may be. Once you’ve captured the traditional stuff, don’t forget about your fun aspirations—growing your sneaker collection, traveling the world, adopting 30 cats. You’re brainstorming, so don’t worry about which are realistic, just get them all down. Some may seem like improbable, overwhelming, long-term ideas, but this exercise will move them closer to reality.

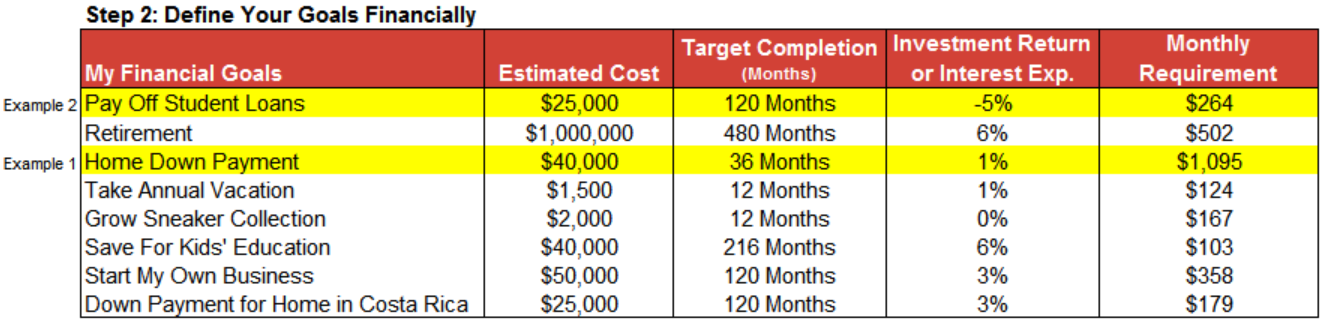

Step 2. Define Your Goals Financially

Defining your goals financially is the process of making them measurable and comparable. It translates them from a giant leap into distinct, achievable monthly steps. Let’s try an example. Goal: You want to buy a home. Now, work backward asking yourself important questions to define it.

What’s the estimated price? $200,000

Will I pay cash or have a mortgage? Mortgage

What will be my down payment? 20% or $40,000 ($200,000 X 20%)

When do I want to buy a home? 3 years

By having answers to these questions you can calculate the amount you need to save each month to achieve your goal: $40,000 / 36 months = $1,111 per month. A measurable figure that is comparable to your other goals. Then take it one step further by considering that you’ll use a high-yield saving account with an interest rate of 1% to save. Using the financial priority matrix spreadsheet, or a financial calculator, you can calculate that you actually only need to save $1,095 per month, because your savings is invested and growing at a rate of 1%. Write down the financial definition for each goal you identified in Step 1 and fill them into the financial priority matrix as seen below.

This example goal (buying a home) is a saving goal. For example 2, let’ try a debt goal: Pay off student loans. Again, ask yourself some questions to define it.

How much do I have in loans? $25,000

When do I want my loans to be paid off? 10 years

What is the interest rate on my loans? 5%

You can see that the questions are not always the same. You need to determine what information is important for breaking your goals down into monthly dollar figures. By plugging the answers from example 2 into the financial priority matrix, you can calculate that you’ll need $264 a month to meet your goal of paying off your student loans.

Investment return or interest expense: In the matrix above, the goals, estimated cost, and target completion columns come from your answers when defining your goals. For each goal you are either paying interest (debt goals) or receiving interest (savings goals). If the down payment for your home is held in a high-yield savings account that pays 1% interest, you don’t need to save a full $40,000. You need to save the amount that will grow to become $40,000. The investment return or interest expense column factors that into your monthly payment, reducing it for savings goals (because you receive interest) and increasing it for debt goals (because you pay interest).

What is the right interest rate for you goal? Well if it’s a debt goal, use the rate you are charged on the debt as a negative number (see example 2 above). If it is a savings goal, it depends on your time horizon. Your time horizon will help you decide the proper level of investment risk and therefore your excepted return. Check out the post “Where Should You Put Your Lazy Money” for more information about the relationship between time horizons, risk, and investment returns. (I’ve also included some general rates to be used in this exercise in the financial priority matrix linked above).

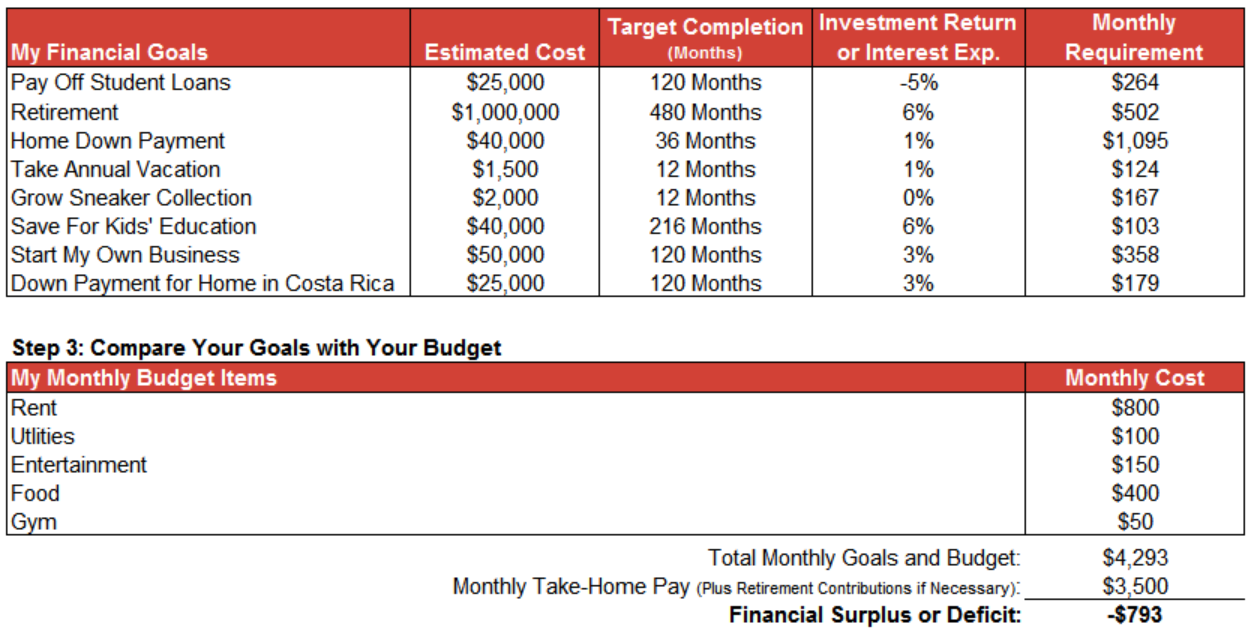

Step 3. Compare Your Goals with Your Budget

Now that you’ve defined all of your goals financially, the next step is to see how they fit into your budget. You have a set amount of financial resources based on your income, and every purchase you make is a statement regarding your priorities. That’s what makes comparing your goals with your budget so important. If you spend $100 on ice cream each month, you have effectively prioritized ice cream over other goals. The fact that financial resources are not infinite is what makes having power over your spending so important. You need awareness of where your money goes, so that you can decide if that’s where you really want it to go!

To compare your goals with your budget, plug your monthly spending and income into the matrix, as I have below. (For your income, use your take-home pay. This is the amount on your paycheck after taxes and employee benefits. If retirement savings is a goal—as it is in the example matrix—you’ll want to add your retirement contributions and employer match to your take-home pay.)

Step 4. Prioritize Your Goals

Now that you’ve compiled all of your goals, income, and spending, you’re ready to prioritize. In the example, it is clear there are too many goals for this level of income (because of the $793 financial deficit). That’s fine! That’s to be expected if you took the brainstorming (Step 1) process seriously. The idea is to get a full picture of everything you want to accomplish and be able to compare it with reality. Who knows, maybe you discovered you’re able to do more than you thought.

The important thing to remember is that all expenses are negotiable. Yes, you need food and shelter… but do you need your own place when you could find some nice cat people on Craigslist to be your roommates? To prioritize competing financial objectives, think about which goals are current, which ones could wait a few years, and what changes you’d like to make to your budget.

In the example, student loans, retirement, annual vacations, sneakers, starting a business, having a nicer apartment, and eating well were identified as current financial priorities. To accommodate these priorities, the saving for a home down payment, kids’ education, and Costa Rica vacation home goals were pushed out a few years. By delaying these goals, financial resources are freed to increase the rent and food budgets, as well as move the starting a business goal forward a few months. Your goal priorities, in this sense, are start dates for when you’ll begin accomplishing them—not a list from one to ten. Check out these highlighted changes to the matrix below.

Conclusion

Setting goals can be a lot of fun and very empowering! You may finally gain the confidence to start down a path toward your lifelong dreams of being debt free, owning a home, and having a prestigious coin collection. You get to dream big, think about what’s important to you, and proactively determine how you want to live your life. Use the provided financial priority matrix to walk through each step. Brainstorm, define your goals financially, compare them to your budget, and then prioritize them. It will be an eye opening experience. Be prepared: You may find out that your daily trips to Starbucks are costing you that house you’ve always wanted. Or, maybe the guilt caused by your shopping habit will subside, as you gain financial proof that it easily fits with your other priorities. Whatever the outcome of the exercise, the clarity it brings will undoubtedly be good. Ignorance is NOT bliss when it comes to achieving your financial goals!

Are you interested in getting one-on-one advice on managing your competing financial priorities? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.