So you’ve got some money saved up and you’re thinking: “This lazy money is just sitting around! It’s about time it gets up off the couch and finds a job. Start working for me! But what investment should I choose?”

tpattersonart.com

tpattersonart.com

To begin making your money work for you, you need to understand a bit about stocks, bonds, and the market. Maybe you already do, and that’s great! However, for those of you who hear “market” and think “farmers” as your mouth starts watering for fresh produce and slow drip coffee… this blog post is especially for you.

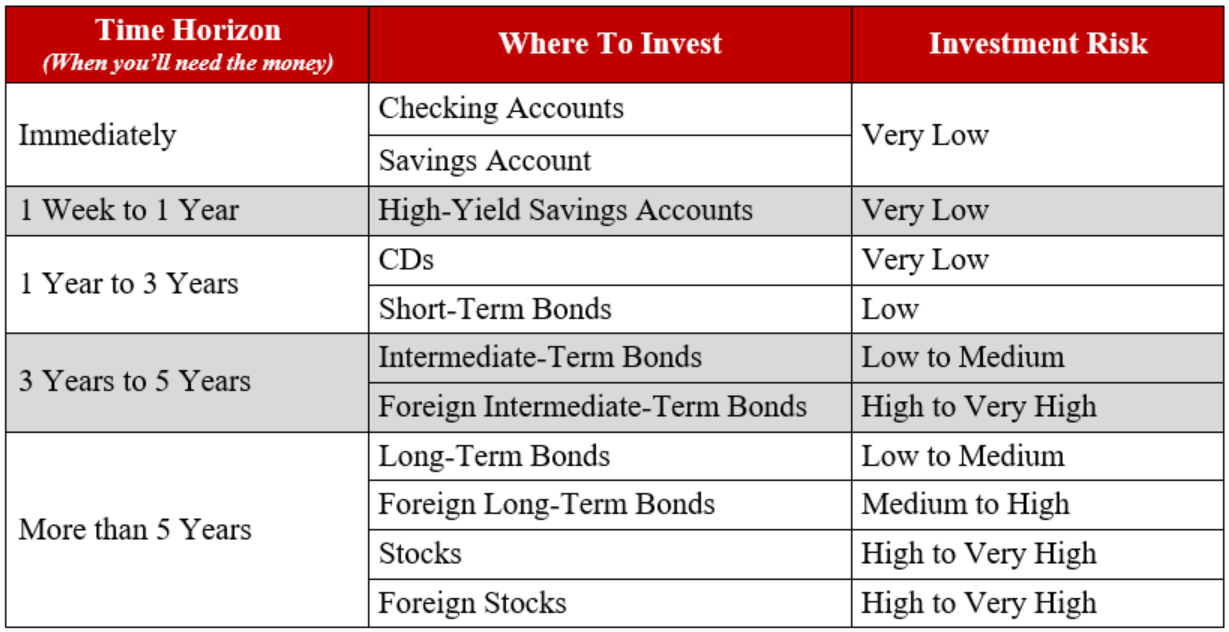

Investing doesn’t have to be complicated. There is a natural progression from safe to risky investments that’s easy to follow. Put simply, your time horizon, and to some degree your risk tolerance, should dictate the investment you choose (check out 5 Keys to Understanding Investment Risk for a refresher on these terms and types of risk).

Checking and Savings Accounts

A Checking Account is not an investment in the sense of seeking a return, but an investment in convenience. Money is held in a checking account to meet immediate financial obligations.

The big question is always “How much money should I keep in my checking account?” The simple answer—enough to meet all immediate financial obligations! Add up your rent, utilities, average monthly spending, and then double it.

Too often people maintain almost nothing in their checking account, sweeping all extra funds to a savings account. While this makes sense in theory, seeking higher returns, I disagree with doing it aggressively. Interest rates on savings accounts, even high-yield savings accounts, are paltry. These returns can be wiped out in an instant by maintaining a low checking balance and getting hit with an overdraft fee. Figure out your number, then double it or add a buffer. The return is not worth the risk.

Standard overdraft fee = $25

Funds required to earn $25 at a 1% rate over a year = $2,500

A Savings Account is the safest form of investing and the best short-term option. In essence, you are lending money to a bank that you can access on demand.

What is the risk of a savings account? There are two main risks involved with savings accounts—the first is credit risk. Although it is unlikely a bank won’t repay you, it is possible. In 2015, eight U.S. banks failed. Fortunately, all were FDIC insured and therefore their account holders were protected. FDIC insurance provides protection against credit risk for up to $250,000 of losses in event of an insured bank’s failure.

Low risk = low reward! The current rate on a Bank of America savings account is 0.03%. An account balance of $100,000 will only receive $30 in interest for a whole year! This low return introduces the second risk involved with savings accounts and other low-return investments: inflation risk (losing purchasing power over time). To battle inflation risk you must seek higher returns through higher risk investment vehicles for a portion of your long-term investing.

High-Yield Savings Accounts

High-yield savings accounts offer higher interest rates at the same level of risk as traditional savings accounts (thanks to FDIC insurance). This makes having a traditional savings account unnecessary.

High-yield savings accounts are generally only available at online banks. These banks can offer higher interest rates because they have lower cost structures (no branches and fewer employees). Their only drawback is that it may take additional time (over that of an account at a traditional bank) to withdraw your money. You’ll want to maintain a checking account with a traditional bank to transfer money in and out of the online-only bank. This process generally takes three business days, but is worth it for the higher rate.

Synchrony, Ally, Barclays, CIT, and Capital One all offer high-yield savings accounts with interest rates right around 1% (still not high enough to beat the long-term inflation rate of 3.2%). An account balance of $100,000 invested at 1% would make $1,000 in a year (versus $30 in the savings account example above). Check out NerdWallet’s summary of best high-yield savings accounts here.

Certificates of Deposit (CDs)

CDs, another form of simple lending, can be obtained online or at a traditional bank. They typically offer a slightly higher rate than high-yield savings accounts (perhaps 1.25% instead of 1%, but still less than inflation). The trade-off with a CD is you commit to investing for a predetermined period of time (generally 3 to 60 months). Early withdrawals usually involve giving back all or some of the interest earned.

CDs can be a great investment choice for short-term goals. If you are buying a house in a year and a half, consider placing your down payment in an FDIC-insured 18-month CD. This allows you to receive a return with minimal risk of nominal loss.

Short, Intermediate, and Long-Term Bonds

Like all the investments discussed above, bonds are a form of lending. However, they are slightly more complex. Bonds are issued by governments and companies, and are not FDIC-insured. This means the risk of not receiving your investment back in full could be substantial.

A bond is like an I.O.U. It is a promise to repay the investor (you) a specific amount of money in the future. However, these I.O.U.s are not scribbled on a napkin by your little sister. They are legal documents that include a specific repayment date and an obligation to pay you interest.

What is the risk of investing in bonds? Bonds can be extremely safe or extremely risky depending on the government or company acting as the borrower. We all have people we’ll lend money and others we won’t. You might trust your uncle Mario, but your sister Susan— she’s burned you one too many times.

Lending to companies and governments is similar. A company that is making a lot of money, like Apple, would have no trouble repaying you. The expectation is that lending to Apple is very safe (low credit risk) and their interest rate will be correspondingly low. Argentina, however, has a history of stiffing its bondholders. The country is still able to borrow by issuing bonds, but must pay a high interest rate to compensate investors for their relatively high credit risk.

Why do bond prices change? When you purchase a bond, you know the amount you are lending and for how long. The interest rate, however, is based on the going market rate and the credit risk of the borrower. When either of these two factors change, the value of the bond will adjust. This can work in your favor or against you. It is important to note that unless the borrower defaults or you sell your bonds, these changes are simply “paper” gains and losses. You’ll still should receive the amount lent and interest payments as scheduled.

Why are long-term bonds riskier than short-term bonds? Along with credit quality, a bond’s risk is influenced by its duration. Bonds come in different borrowing periods, or maturity lengths, categorized as short (1 month to 3 years), intermediate (3 to 9 years), and long-term (10 years or greater). Generally, longer-term bonds are seen as having higher risk because there’s a greater period of time over which interest rates and the borrower’s creditworthiness can change. To compensate for this increased risk, longer maturity bonds generally have higher interest rates than shorter bonds.

Stocks

A stock is a form of partial ownership of a company. If you purchase one share of Facebook stock you truly own a very small fraction of the company (think 10 decimal places small). You purchase stocks for two different reasons: dividends and capital appreciation.

Dividends: Companies do two things with their earnings—invest back into the business or return cash to owners (referred to as stockholders or shareholders). When they pay out their earnings to shareholders it’s called dividends. It’s similar to receiving bond interest except the company has more flexibility. The Board of Directors (BOD), a group appointed by shareholders to oversee a company’s managers, chooses the dividend timing and amount.

Capital Appreciation: Not all companies pay dividends. This generally happens because the BOD believes reinvesting in the business will create greater value for shareholders in the long-term. These companies could still be good investments if you believe they will grow. Growth may lead to the business becoming more valuable and the stock price increasing.

What is the risk of investing in stocks? Share prices can and will go down. It could be a slowdown in growth, a decline in earnings, a weakening economy, shift in customer taste, or just competition. There are so many factors! Some of the factors have nothing to do with the company, which is what makes stocks so risky.

Foreign Stocks and Bonds

Foreign stocks and bonds are important for long-term investing. In essence they are the same as the domestic variety, but higher risk because of political and currency risk. Many countries have less stable governments, looser investor protections, less transparency, and volatile currencies. All of these factors increase investment risk.

This added risk, however, brings greater potential returns and can actually reduce your overall investment risk by increasing diversification! This happens because other countries and economies may not move in tandem with ours. When domestic investments are falling, foreign investments may be increasing in value. This makes foreign stocks and bonds a valuable addition for long-term investors, because they can decrease overall risk while also boosting returns.

Conclusion

Making your money work for you (through investing) is key to financial success. However, with so many investment options, it’s important to choose the right one. Savings accounts, CDs, bonds, stocks—each have their own risk and place in your portfolio. Before choosing, consider your goals for the lazy money. This will allow you to determine your time horizon and make a choice that aligns with your objective.

Are you interested in getting one-on-one personalized advice on investing? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.

tpattersonart.com

tpattersonart.com