It’s that magical time of year again! Leaves are changing color, the smell of smores and campfires is in the air, and your HR department is emailing you about open enrollment. You’ve got work to do, deadlines to meet, and the last thing you need is another task in your way. Where do you even start? To help you out, I’ve prepared this guide to making this a smooth election year.

tpattersonart.com

tpattersonart.com

Learn the Lingo – The Vocabulary of Health Insurance

Before you choose your health insurance, you need to know your options and identify the tradeoffs. To do that, you need to be familiar with the lingo.

Premiums – The amount you pay monthly, as a pre-tax deduction from your paycheck. Premiums are basically health insurance membership dues. It’s like a country club membership: A few services are included, like access to the pool or annual checkups, but you pay extra for golf or surgery.

Deductibles – The amount you would have to pay for medical care (such as doctor visits) in a given plan year before insurance kicks in and picks up the tab. Deductibles have an inverse relationship with premiums. You may have the option to pay lower premiums each month, but this will be paired with a higher deductible.

Co-Payment – A fixed dollar amount that you pay for a specific medical service or healthcare product. For example, you may be required to pay $15 for a prescription to be filled or $10 to visit the doctor. Co-payments rarely count towards meeting your annual deductible (it depends on the insurance plan), but they do count towards your total out-of-pocket maximum (discussed below).

Co-Insurance – Is similar to co-payments, in that they vary per medical service, but instead of being a fixed dollar amount they are a percentage of the total cost. For example, you may be responsible for 15% of the post-deductible cost (up to your total out-of-pocket, discussed next), and your insurance will pay the other 85%.

Total Out-of-Pocket Maximum – The maximum dollar amount you can be held responsible for in combined deductibles, co-insurance, and co-payments in a given plan year. Just like deductibles, plans with low premiums have higher out-of-pocket maximums.

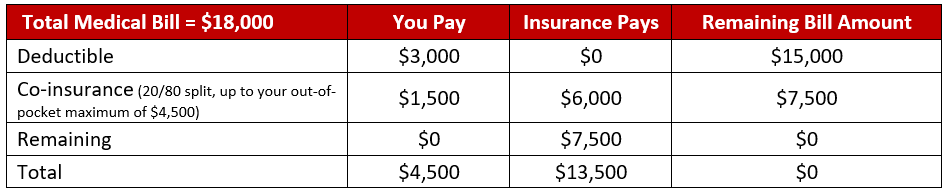

All of these terms work together in your healthcare plan to determine the price you pay for service. For example, let’s say you’re building a treehouse, get spooked by a bird, drop your beer, slip on the can, and fall out of the tree. Your medical bill ends up costing $18,000. Let’s figure out how much it will cost you under the following coverage:

Monthly premium: $200

Annual deductible: $3,000

Co-insurance: 20%

Annual out-of-pocket maximum: $4,500

First, recall that the premium is your monthly membership dues – so not a factor here. The first important number is your deductible, which indicates that you’ll be responsible for the first $3,000 of the bill. After that, insurance partially kicks in and covers 80% (you cover the other 20%) up to your out-of-pocket maximum, which is $4,500. See below for how this shakes out between you and the insurance company.

Family Plans – A policy that covers more than one person (you and your spouse, child, or dependent parent). On a family plan, everyone shares one annual deductible and out-of-pocket maximum. Both figures will be higher, but not necessary proportionally higher based on the number of insured people.

Identify Your Options – Differences Between Health Care Choices

Preferred Provider Organization (PPO) Versus Health Maintenance Organization (HMO)

Many employers, but not all, offer a choice between two different health insurance systems—PPOs and HMOs. I liken this to choosing between the two major cell phone operating systems, Apple and Android. An HMO, like Apple, is a closed system. It’s a one-stop-shop where everything was designed to be a seamless and easy experience. A PPO, like Android, is an open system. It’s more robust, offering additional options, and customizations.

An HMO will vary depending on the company or group plan, but generally member medical professionals are part of a hospital system that handles all aspects of your medical needs. You might see your doctor on the 5th floor, go down to the basement to get your blood tested, and pick up your prescription on the way out on the main floor. Every part operates together sharing resources to make it easy and efficient.

In my most recent checkup my doctor ordered some routine blood work. To my delight there was no appointment for the bloodwork. I could show up at any of the HMO’s hospitals, at any time over the next three months, and they would be able to take care of me. Much like Apple, an HMO is a walled garden and so long as you stay within the boundaries everything should work beautifully.

The downside to the HMO system comes when you want to leave the garden. HMOs are likely to charge small co-payments ($10-$20) inside their system, but rely on co-insurance for expenses incurred outside their system, making it more expensive for you. You may find yourself outside of the garden because you are traveling outside your home region, or you want to visit a specialist or specific doctor (perhaps a family friend) outside your network.

A PPO, on the other hand, is a network of independent doctors and medical professionals. Much in the way there are multiple makers of Android phones, doctors can opt into whichever PPO networks they wish. This leads to a larger variety of options and greater choice for you as a consumer. Like HMOs, you can visit a medical professional outside of the PPO network, but the co-insurance rates are likely to be less favorable.

The downside to greater choice under the PPO system is that, because the system is not completely integrated, it may not flow as smoothly as an HMO would. Different hospitals, doctors, and specialists operate on different systems and cannot share information or services as seamlessly.

Prioritize Your Preferences

There are certainly cost considerations, but the health insurance decision can also boil down to personal preference. Therefore, you need to know what’s important to you during open enrollment! Ask yourself some questions to help determine your priorities.

Cost:

– Do any of my options provide better coverage for my specific medical situation?

– Do I expect that someone in my family will visit the doctor often?

Options:

– Do I have a preference for a certain doctor or location?

– Is having the option to visit specialists around the country important?

Taxes:

– Does my employer offer FSAs?

– How important is having an HSA?

Pick Your Plan – How to Compare Health Insurance Options

You’ve learned the lingo, identified your options, and prioritized your preferences, now it’s time to pick your plan!

How to Choose Between PPO and HMO

Apple and Android users are generally pretty passionate about their choice. Android lovers can’t imagine why anyone uses Apple and its tightly controlled and inflexible operating system. Others love its simplicity, design, and ease of use. Making the choice between an HMO and a PPO is similar. Are you looking for a one-stop-shop that will handle all of your medical needs from end to end, or the flexibility to seek out specialists and specific doctors?

There are three primary situations in which you would want to choose a PPO over an HMO. First, if you are unlikely to use your insurance and are simply looking for the cheapest option. Second, if you have a doctor that you know and love. Third, if you want a health savings account (HSA). As discussed in the post The Power of the Health Savings Account, HSAs are only available for high-deductible health plans (HDHPs), which HMOs are not. However, missing out on an HSA isn’t a big deal if your employer offers medical flexible spending accounts (medical FSAs), but these accounts are not as robust as HSAs.

Premiums, Deductibles, and Out-of-Pocket Maximums

Recall that premiums have an inverse relationship with deductibles and out-of-pocket maximums. During open enrollment, you’ll likely have to choose between these tradeoffs. Do you want to pay more each month for medical coverage (premiums), or when you visit the doctor (deductibles and out-of-pocket maximums)?

The simplest way to make this decision is to think about how often you’ll use your insurance. The media uses the term “young invincibles” to describe young, healthy people that rarely visit the doctor. If you are invincible, a PPO with a high deductible would likely be your best choice from a cost prospective. You’ll pay less in premiums each month and since you rarely visit the doctor won’t pay the high deductible.

On the flip side, if you visit the doctor often, a low deductible PPO or an HMO plan may make the most sense. You’ll pay higher premiums each month, but you’ll reach your annual deductible and out-of-pocket maximum faster. This will allow your insurance to pick up the tab sooner and leave more money in your pocket.

Choosing Insurance for Married Couples and Families

Married couples may have more insurance options and therefore a more complex decision to make. Don’t automatically assume a family plan will be advantageous. It may be cheaper or you may obtain better coverage by enrolling in two separate individual plans. Further families may find their best option is for one spouse to have a family plan that covers the kid(s), while the other spouse remains on his or her own individual plan.

Conclusion

Open enrollment is an exciting time of the year! A new year, without any procrastination. Well that was the plan, but you forgot and just received an email from HR because enrollment closes at 5 o’clock and you haven’t made your selection. Fortunately, you’ve read this article, know the lingo, understand your options, and have identified what’s important. “Challenge accepted HR guy, I’ll make my election in no-time.”

Easy to understand definitions and examples of terms—very enlightening

Thank you, Debbie!