I cringe when I see people use a debit card or cash. I want to jump across the counter, grab their arms, and scream “What are you doing!?! You’re wasting money! Don’t you care?” Of course I don’t, but the feeling is there. Everyone knows about credit card rewards, so why do so many people fail to take advantage of them?

It’s pretty easy to get paid an average of 2% for using credit cards. Assume you spend $1,000 per month between groceries, gas, restaurants, entertainment, and shopping. That’s $12,000 per year. By using a credit card and getting 2% back, you could earn $240 in rewards per year! Enough for a wild week of dining out, an Apple Watch, or a mountain of Twizzlers.

The Rewards Continuum: Neglectful, Lazy, Crazy

When it comes to credit cards everyone falls somewhere on the continuum. You may be thinking “Hey! Come on David, I read the title. I would never describe myself as neglectful, lazy, or crazy!” Well, depending on how you use credit cards you fall into one of those three categories.

Neglectful with Credit Cards

Ok, you may have an excuse for not using credit cards. If you’re not following the 11 Rules For Using Credit Cards Wisely, maximizing your rewards points is not your most pressing concern. You should focus on having a budget, paying off your balance in full each month, and having control over your spending. Credit cards are a double-edged sword and you must be able to handle them without cutting yourself before you can use them to your benefit. If this is the reason you’re neglecting the advantages of credit cards, good. You’ve got your priorities straight and know where to focus your energy. But this is the only acceptable excuse for being neglectful!

Crazy with Credit Cards

On the other end of the continuum is the crazies. There’s a whole world of people out there that live and breathe credit card rewards and airline miles. If you’d like to venture down that rabbit hole for a few hours check out The Points Guy or Google the term “manufactured spending”. Credit card rewards can allow you to fly around for free, stay at luxurious hotels, and upgrade your flights, but being on that level is a lot of work. There’s nothing wrong with being crazy with credit cards, but you have to be responsible and willing to do the work. It involves meticulously tracking your spending, which cards you have, when you’ve opened them, and knowing the intricacies of different rewards programs. If you’re crazy with credit cards, it’s extremely important to keep accurate records in a spreadsheet. It’s too easy to miss a payment, forget about a card, or make a mistake. One false move could severely damage your credit, negate the benefits of your work, and carry over into other aspects of your financial life. If you’re crazy with credit cards, be very careful.

I find myself somewhere between lazy and crazy (although my wife would likely say I’m full blown crazy). I’ll admit there have been weeks when multiple new credit cards come in the mail and I jump around like an excited kid on Christmas. But remember, I’m an accountant. I love spreadsheets and am happy doing the work to ensure that I’m being a responsible crazy credit card user.

Lazy with Credit Cards

Let’s be clear, being lazy with credit cards, in this context, is a good thing! It’s the best spot for the grand majority of people. Being lazy is about being efficient and taking advantage of the Pareto Principle, or the 80/20 rule as it’s commonly known. Our goal is to get 80% of the potential rewards points, for 20% or less of the effort.

Being lazy is different from being neglectful. If you’re paying with cash or a debit card, you’re leaving money on the table. You’re neglecting the opportunity to further yourself financially. Being lazy is different than being crazy as well, because you’re not dedicating significant time to get every single reward point possible (like a crazy person would). There is nothing wrong with being crazy, it’s just more involved. You have to do a lot more work. Being lazy, on the other hand, is simple, effective, and only requires a little legwork upfront.

Maximum Rewards, Minimal Effort

Step 1: Get a Good Everyday Card

Everyone should have a go-to credit card: a default, a main squeeze. What I mean is a credit card that offers above average rewards (1% is average, so we’re talking 1.5-2%), no matter what you’re purchasing. The Citi Double Cash Card pays you 1% when you buy and 1% when you pay the bill. Another option is the Chase Freedom Unlimited, which pays 1.5% cash back for every purchase. Having a strong go-to card allows you to build rewards points quickly without having to think, track, or consider the card you’re using.

When you start looking for a credit card, you’ll find that there’s an overwhelming number of options. Besides looking for one with 1.5-2% cash back on all purchases, you should avoid cards with annual fees. You may think the fees are justified by higher rewards or sign on bonuses, but remember the approach we’re talking about here: the lazy system. We don’t want to put the time in to track and ensure we’re making the purchases necessary to warrant the fee. (Nerd Wallet is an excellent source for filtering through available credit cards and finding the right one for your situation.)

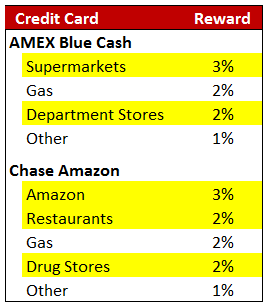

Step 2: Identify Some Categories for Extra Rewards

Once you have a good default card for your everyday expenses, you’re ready to add a little juice. This means finding one or two additional cards that will give you 3-5% cash back on specific expenses that fit your lifestyle. Start by identifying your major spending categories: restaurants, gas, groceries, etc. (If you have power over your spending, this should only take a minute). Then use Google or Nerd Wallet to identify which cards are best for that category and apply. I’ve listed a few potential cards to get you started below:

| Expense Category | Card | Reward |

| Groceries | AMEX Blue Cash | 3% |

| Gas | BankAmericard Cash Rewards | 3% |

| Amazon | Amazon Store Card | 5% |

| Target | Target Red Card | 5% |

When comparing cards to juice your rewards points accumulation you should again avoid cards with annual fees, but also be aware of cards with “opt-in categories” or “category rotation”. What I mean are the cards that offer 5% cash back for different spending categories each month or quarter. These can be extremely lucrative and there’s no need to avoid them, but they require additional work. You have to remember which category is currently offering the bonus reward and possibly activate them each period—not exactly the lazy system. It’s better to choose a card that always offers high rewards in your top spending categories instead.

tpattersonart.com

tpattersonart.com

Step 3: Know When to Use Which Card

Now that you’ve got a few credit cards (2-3), you need to know when to use which one to maximize your rewards. The good news is that if you have a strong everyday card, you’ll at least get 1.5-2% for all of your purchases. But squeezing in a few 3-5% reward purchases can make a big difference. If you get store cards (like Amazon or Target), it should be very easy to remember to use that card in the store. For everything else it will just take time to get in the habit. “Ok, I’m at Trader Joe’s. That means I use my AMEX!” Being the organized nerd (and crazy credit card user) that I am, I created a wallet insert for my wife and I. It lists our major credit cards, the rewards we get for different categories, and highlights the best to use in certain situations.

Step 4: Use the Rewards

This is what it’s really all about right! So what’s the best way to use your rewards points after you’ve accumulated them? This is a very personal decision and will depend on your budget and financial situation.

The Responsible Decision

The clear choice if you want to better yourself financially is to apply your rewards points as a statement credit or receive a check to deposit into your account. This is the responsible decision because it’s unlikely to cause you to increase your spending above your budget and purchase something you hadn’t planned on buying. A statement credit will simply decrease your monthly bill, increasing your cash flows, and the money in your account.

The Fun Decision

Blow it on something you want! Use your rewards as a way to save for travel, clothes or something else outside of your budget. While this is less fiscally responsible, because it increases the odds you purchase something outside of your spending plan, it can be extremely motivational. My wife and I hold each other to our spending plan each month, but rewards points are fair game. When we go out to eat, or have a big expense to pay for, we fight over the check. We both want the points! It’s also the reason my wife uses her credit card wallet insert. We are both trying to maximize our credit card rewards because we have things we want to purchase using the points.

Don’t Make Excuses!

So long as you’re using credit cards responsibly, with a budget and spending plan, there’s no excuse for not using them for (almost) everything. Credit cards have fraud protection, they’re convenient, and you’re paid in the form of rewards! What’s not to love? You don’t have to be crazy to implement a system that captures significant rewards and puts hundreds of dollars in your pocket. Don’t be neglectful with credit cards, be lazy. Give the system a try and watch your rewards pile up. Soon you’ll be just like me. Holding back the urge to scream when you see one of your friends pay with a debit card!

Are you interested in getting one-on-one personalized advice for maximizing your rewards points? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.

You’re speaking my language now. Financial planners don’t seem to go down this road when this is some of the most approachable information for regular folks.

I’m definitely in the crazy camp myself and having some more in depth knowledge really helps you find those niche cards. In this day and age, you should be getting a minimum of 2% on your base card and 5% in most category spend.

2% base cards

Citi as mentioned above

Fidelity Rewards (need a Fidelity account to deposit rewards into)

!!2.5% base card!!

USAA (if you qualify)

Category spend:

AARP Card – 3% restaurant spending

Sallie Mae Card – 5% on $250/month on gas, 250/mo on groceries and 5% on 750/mo on book stores (Amazon qualifies!)

I’ve got a slew of other cards I’ve used in the past for the signup bonuses or lucrative “first 6 months double rewards” deals, but they go in the sock drawer to keep my total credit limit high and utilization low. The rotating category cards are too much work, I agree with you there.

Keep up the good work here!

Thanks for sharing Dan the Man! That Sallie Mae card sounds amazing, it hits on all the key categories.

You are making me think if I should use a Cash Back card instead of a Marriott Rewards card to get the points toward travel. I guess over the Holidays I will have to evaluate.

If you’re being lazy cash back is definitely the way to go! Getting your money’s worth out of miles and points requires booking luxury hotels in expensive cities and taking international flights. If you’re booking average hotels and flying domestically like most people, cash back will put more money in your pocket than points will save you on travel.