It’s that time of the year again—every afternoon we race to our mailboxes to see what new tax documents the postman has delivered! W-2, 1099, 1095, 1098, 5498, K-1… what is all this stuff?!

There are a lot of tax forms out there and Form W-2 is one of the most important. This small document details the tax effects from many decisions we made throughout the year. If you want to maximize your tax savings and increase your refund, understanding how your decisions effect your W-2 is a great place to start.

Common Form W-2 Questions

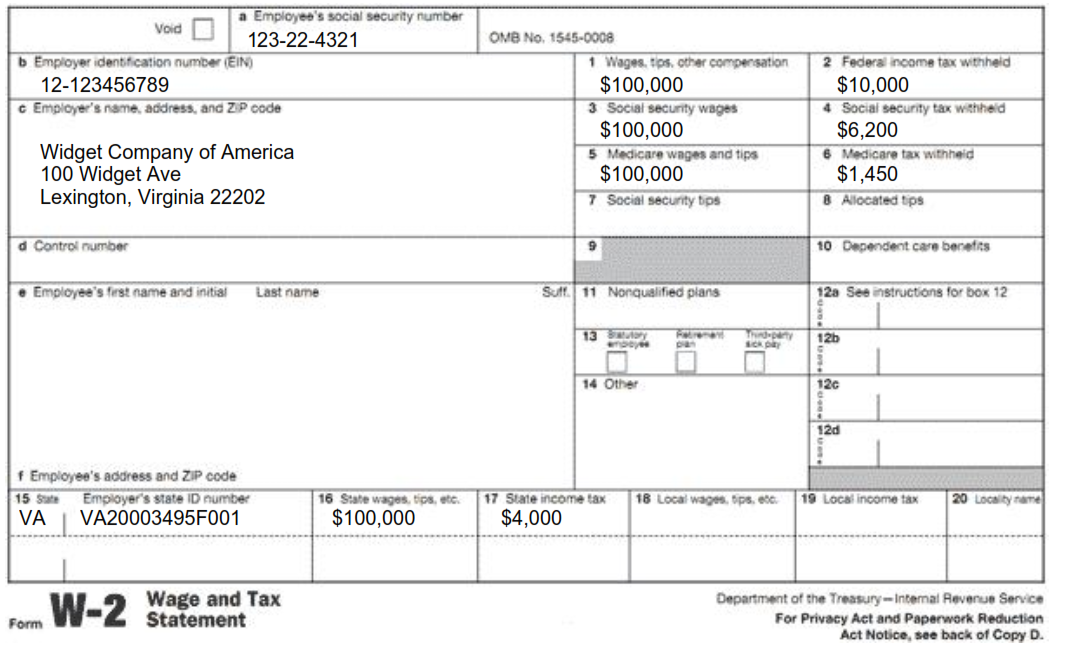

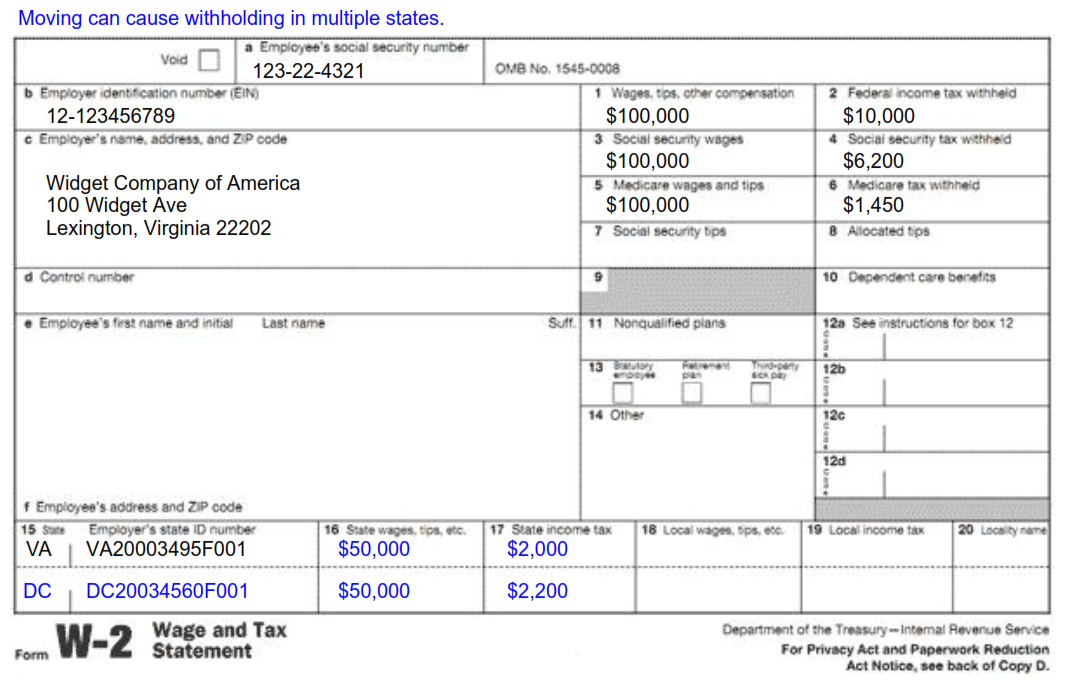

The most common tax document is Form W-2. It is a statement of wages, benefits, and taxes. Each W-2 can look a little different, but they all organize the same information using a box and code system.

Why Are There Four Copies of My W-2?

Receiving four copies of your Form W-2 is a relic of the paper filing age (which is not extinct). When you paper file, a copy of your Form W-2 is stapled to each of 3 potential returns (Federal, state, and local), and the fourth is for your records. In today’s e-file world, multiple copies are rarely needed because an electronic version of your W-2 is sent along with each return.

Why Are My Social Security and Medicare Wages Higher?

The first thing that many people notice when looking at their Form W-2 is that the figure in Box 1 (wages) does not match the figures in Boxes 3 and 5 (Social Security and Medicare wages). The variance is often caused by pre-tax contributions to a 401(k), 403(b) or another retirement plan. If this is the case, the difference between the values should be reported in Box 12 using code D, E, F, G or H (more on this later).

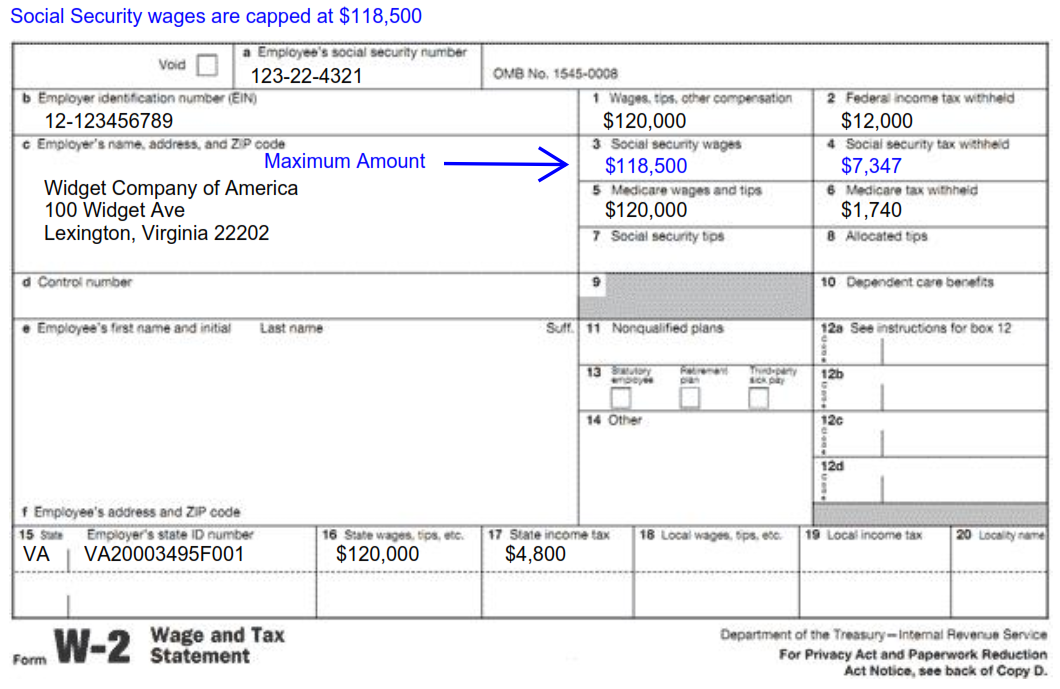

Social Security wages (Box 3) could also be lower than the figure reported in Box 1 if your compensation is above $118,500. For 2016, Social Security taxes are only applied to your first $118,500 in earnings, therefore this is the maximum amount you’ll see reported in Box 3.

What Are Social Security and Medicare Taxes?

Boxes 4 and 6 on Form W-2 list your “payroll tax” payments. These are mandatory payments for all U.S. workers toward the Country’s big social welfare systems: Social Security and Medicare. These taxes are automatically calculated by your employer, deducted from your paycheck, and remitted to the Government.

Social Security taxes are 6.2% of your first $118,500 in wages. These payments accumulate and increase the amount of Social Security benefits you’ll receive in retirement. Which are no strings attached payments from the Government.

Medicare taxes are 1.45% of your first $200,000 in wages, and 2.35% for wages above that level. These taxes pay for medical insurance coverage for people over age 65. Once you reach age 65, you can apply to receive these Government too.

Why Don’t My W-2 Wages Match My Pay Stub?

There are several reasons why your W-2 wages are not going to match your pay stub. The first, is mentioned above: pre-tax contributions to retirement accounts. Other common reasons are Health Savings Account (HSA) contributions, commuter benefits programs, and insurance payments. All of these benefits are pre-tax deductions, meaning they are subtracted from your compensation to calculate the wage figure reported in Box 1.

While having taxable wages that are less than your pay stub is more common, it’s also possible to have higher taxable wages. If your employer pays for life insurance coverage with a benefit above $50,000 or provides tuition assistance above the $5,250 tax-free limit, the additional amount could be reported in Box 1 of your W-2.

Are the Dependent Care Benefits in Box 10 Taxable?

If your employer offers Dependent Care Flexible Spending Accounts (FSA), your contribution will be reported in Box 10. This amount has already been deducted from your wages in the calculation of Box 1. However, it is important for tax reporting purposes because you must provide documentation that supports that the amount contributed was used to pay for childcare expenses. If you do not provide the proper documentation, the figure in Box 10 will be added back into your taxable wages.

What Do All the Codes in Box 12 of the W-2 Mean?

Box 12 is a treasure-trove of information. Each entry reports an amount, along with an identification code ranging from A to EE. Most W-2s contain a detailed listing of the codes on the back. Some of the most common are:

C – Taxable cost of group-term life insurance. As mentioned above, life insurance coverage over $50,000 is taxable to the employee. For example, if your employer provides $60,000 of life insurance coverage, the premiums for the first $50,000 will be tax free. The cost of the next $10,000 of coverage (which could be just a few dollars), will be reported in Box 12 with Code C, as well as included in your taxable wages in Box 1.

D, E, G – Pre-tax retirement plan contributions. Depending on your employer, you may have a 401(k), 403(b), or 457(b). If you made tax-deductible contributions to any of these accounts during the year, the amount will be reported in Box 12 using code D, E or G.

W – Employer and employee elected contribution to a Health Savings Account (HSA). Code W shows the total amount contributed to your HSA during the year. This figure will include amounts contributed by your employer and the total you elected to withhold from your paycheck.

AA, BB, EE – Contributions to various Roth retirement plan accounts. Again, depending on your employer, you may have a Roth 401(k), 403(b), 457(b). If you made after-tax contributions to one of these accounts, it doesn’t reduce the amount of wages reported in Box 1, but is reported here for informational purposes.

DD – Employer sponsored health coverage. The amount reported using code DD in Box 12 is the total cost paid by you and your employer for your health care coverage during the year.

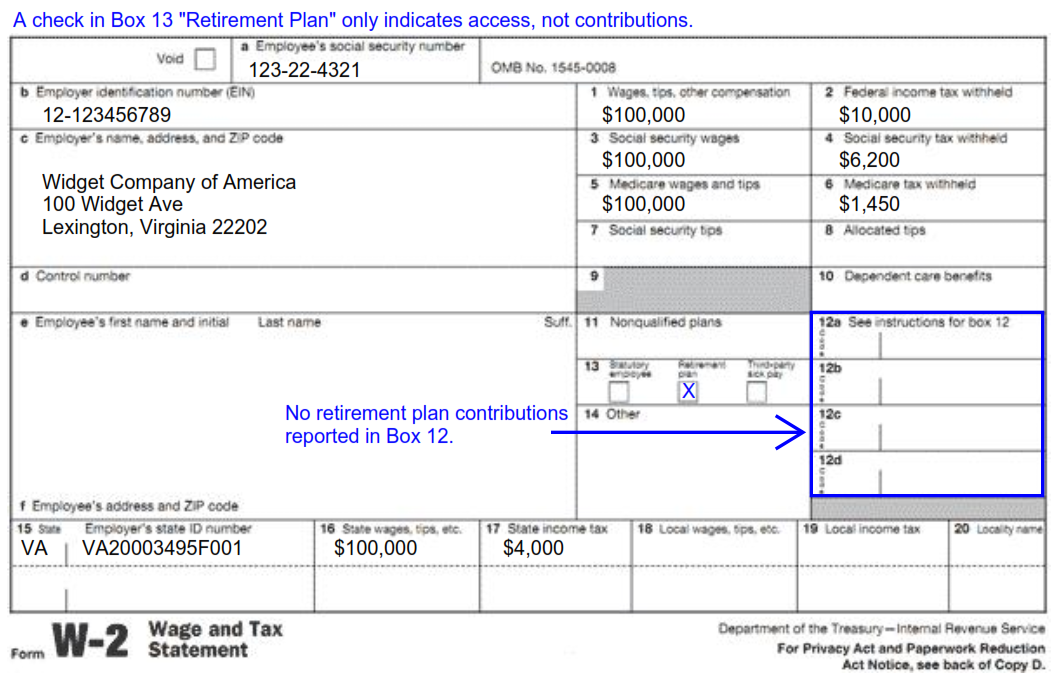

Why Is “Retirement Plan” Checked in Box 13 of My W-2?

Box 13 denotes whether you had access to a retirement plan through your employer. It does not mean that you contributed to it, simply that you could have made contributions. This is important because if you have access to a retirement plan through work, the amount you can contribute to an IRA is limited. Contribute more than the limit in a given year, and you’ll have to pay a penalty which will be added to your tax return.

Why Are Two Amounts Reported in Box 16 and 17 on My W-2?

For those of us that don’t live in one of the 7 magical income-tax-free states (Alaska, Florida, Nevada, South Dakota, Texas, Washington, or Wyoming), there will be information in Boxes 15, 16, and 17. If you have multiple states listed it may be because you moved during the year, or earned money in multiple states. If you live in one state and work in another, you may have to pay tax in both. It depends on the states and the tax agreements they have with each other.

Conclusion

As you can see Form W-2 is full of information. Decisions you make throughout the year and especially around open enrollment flow through to this form and effect the amount of taxes you pay. If you want to save bigly and increase your refund, knowing how your choices will be reported on your W-2 can go a long way.

Are you interested in professional tax preparation and planning this year? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA).

Thanks for the refresher.