Investing is the best way to make our money work for us (remember from the 5 Reasons to Contribute to ESRPs blog!?) and it’s also very personal and emotional. Most of us have a natural loss aversion which causes us to experience losses more deeply than the joy from equivalent gains. This aversion can cause us to think irrationally when faced with the possibility of losing money in our investment portfolio. If we act on these feelings we can make mistakes that cause our investment returns to suffer.

All investments involve risk. If you have ever purchased something with the hope that it will increase in value (even Pokémon cards or Beanie Babies!), you have experienced investment risk. Stocks, bonds, real estate, savings accounts, and the collectibles from our childhood—each involve investment risk because there is some level of probability (perhaps a very high probability) that our dream of payoffs down the road will not be realized.

1. Investment Risk is Expressed as Price Volatility

The first key to understanding investment risk is knowing that it is most often thought of in terms of price volatility. This is easy to quantify for many stocks and bonds because they are traded (bought and sold) millions of times per day. This constant trading results in second-by-second price changes, and plotting these fluctuations can give us a clear view of the average price change over time. Our investment may be worth more than we paid two minutes later, less after three minutes, even less after four, and then more again after five minutes. The volatility of these price movements (measured as standard deviation), gives us an idea of how quickly a particular investment, on average, may gain or lose value.

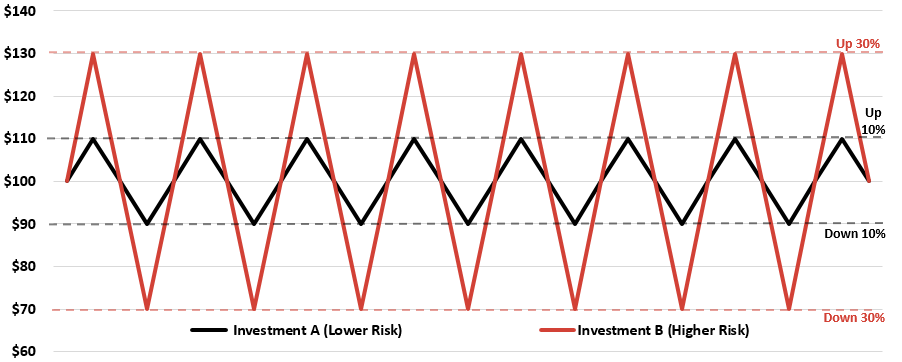

The graph above shows two investments, A and B, with the same average, same start and end values, but very different standard deviations. Investment B at times is down 30%, while Investment A never loses more than 10%. Conversely, Investment B at times has gained 30%, while Investment A never exceeds a 10% gain. Because the standard deviation of Investment B is higher than Investment A, it is considered to have higher investment risk.

Said another way: If we know that the stock we own, on average, changes 10% in value each day, then it’s possible that in a normal three-day period we could lose 30% of our investment. (Just as it’s possible to gain 30% over three days or lose 10%, then gain 10%, then lose 10% again.) Compare that to a stock that, on average, moves just 3% each day. Experiencing a three-day period in which the price falls 30% would be highly improbable because the stock, on average, only moves 3% a day. An investment with a low standard deviation is considered to be less risky.

2. Investment Risk is Composed of Many Types of Risk

So we know that price volatility, as measured by standard deviation, is used to quantify an investment’s risk. But why does the price of an investment change so often? This happens because traders (the people or computers doing the buying and selling) are constantly evaluating new information, interpreting it differently, and reacting by changing the price at which they are willing to buy or sell. The information they are evaluating could be almost anything—economic news, the launch of a new technology, interest rate changes, weather, car sales, airline bookings, peanut prices. All of these factors can have an effect on the price of an investment because all investments are exposed in some degree to a multitude of component risks:

Systematic (market) risk – The risk that the performance of the overall economy will affect all companies and thus could lead to a decrease in the value of all investments.

Non-systematic (company-specific) risk – The risk that even though the economy is doing well, the company’s poor performance causes the value of your investment to fall regardless.

Interest rate risk – The risk that changes in interest rates will negatively affect the value of your investment.

Inflation risk – The risk that your investment will decline in purchasing power because it does not grow as fast as prices are increasing (i.e., the inflation rate).

Political (foreign) risk – The risk of loss involved with investing outside the U.S. in countries that are less stable, have less developed political systems, or have hostile governments that don’t respect ownership and property rights.

Currency risk – The risk of loss in dollar terms caused by changes in exchange rates when investing in another currency.

Credit risk – The risk that the money you lend as an investment is not paid back as agreed upon by the borrower.

Liquidity risk – The risk that when you want to sell an investment, you will be unable to find a willing buyer.

3. Taking Investment Risk is Necessary

As illustrated in the graph under #1, investments with larger standard deviations have a higher risk of loss, but also a greater potential for favorable returns. This is logical, and it is the core of what makes high-risk investments appealing. If all investments (risky or not) had the same potential for return, no rational person would purchase an investment with a high risk of loss. In the cartoon below, the man is presented with two investment options, both of which offer a 5% return. He can either take his chances in the volatility maze or walk straight down the low standard deviation path. To a rational investor, the choice is clear.

tpattersonart.com

tpattersonart.com

Investment risk is necessary because the pursuit of returns, to some degree, is necessary. If the potential return of your portfolio is too low, you may be subjecting yourself to inflation risk. Inflation risk is different than the other components of investment risk because it involves the real value (purchasing power) of your investment, not just the nominal value (actual dollar figure). Low-risk investments (e.g., savings accounts, CDs) are often subject to a high degree of inflation risk because their potential returns are lower than the average annual inflation rate of 3% in the U.S. If you are invested in a savings account yielding 0.03%, your real annual return could be -2.97% when you factor in the loss of purchasing power!

4. Investment Risk Should Match Your Time Horizon

The type of investment you choose depends largely on your investment timeframe, or when you will need the money again. Even a good investment can lose money in the short-term because of the misinterpretation of information by traders or simply because your investment strategy takes time to play out. Whatever your timeframe, you want to avoid any scenario where your cash need forces you to sell an investment at an inopportune time, such as when it has been brought down by the overall market (systematic risk). You may avoid this mistake by following these general guidelines:

| Where To Invest | When You’ll Need The Money |

| Checking | Savings Account | Possibly Immediately |

| High Yield Savings Account | 1 Week – 1 Year |

| CDs | Short-Term Bonds | 1 Year – 3 Years |

| Intermediate-Term Bonds | 3 Years – 5 Years |

| Stocks | Real Estate | More than 5 Years |

Any money you’d like set aside for immediate use in the case of an emergency should be invested in low-risk, low-standard-deviation investments (like high-yield savings accounts). Having an accessible “rainy day fund” will prevent you from having to bail out of your long-term investments at the wrong time. Money placed into a retirement account, by contrast, can be invested in riskier assets, like stocks and bonds, because it will remain invested for a long period of time. If your retirement account investment choice suffers a drop in value shortly after you purchase it, don’t sweat it. Assuming your investment strategy is sound, you will have 10-40 years to recuperate any short-term loses due to systematic risk.

5. Investment Risk Should Match Your Tolerance

Ok… If time horizon was the only determinant of an investment strategy, everyone would have 100% of their retirement account in high-risk investments (like stocks) up until a few years before retirement. The reason we don’t invest in 100% stocks is because we like to be able to sleep at night. Therefore, we consider our risk tolerance, as well as time horizon when choosing our investments.

From the market’s peak in October 2007 to the beginning of the recovery in March 2009, stocks lost 54% of their value. The majority of this fall came between September and November 2008, a period of just three months, when stocks lost more than 30% of their value. I don’t care if you have an iron stomach for investing, those are some big declines. If you were one of the billions of Americans that watched their retirement savings decline so sharply, I’m sure you had at least a few sleepless nights. News anchors were talking like the sky was falling, national banks were failing, and our economy was in a tailspin. Staying invested during that volatile period was extremely difficult for investors, even those with a high risk tolerance. Many people pulled out of the market completely to cut their losses. The problem with this strategy is that they likely missed out on the recovery. Between March and May 2009 stock values increased 30% and finished the year up over 60%.

Now, with 20/20 hindsight, it’s easy to say that those that sold during the downturn made the wrong decision. The truth is that unless you believe the U.S. or world economy is going to completely collapse (at which point your money will be worthless anyway) selling out of all of your investments is the wrong decision. To stop yourself from making an irrational decision, it is important that your investment portfolio is properly aligned with your risk tolerance and investment horizon. The investors that had the proper allocation between high- and low-risk investments in their portfolios were not forced to sell at an inopportune time to meet cash needs, nor did they feel compelled to sell because their portfolios exceeded their risk tolerance.

Before you start investing, you need to understand your tolerance for risk so that systematic short- or intermediate-term declines in the value of your investments do not cause you to sell. If you are not sure how to determine your tolerance for risk, there is a multitude of free questionnaires available online. Google “risk tolerance questionnaire” or check out this one offered by Vanguard.

Conclusion

Making our money work for us, by investing, is a key principal of financial planning. However, if we fail to consider all the risks involved throughout the life of an investment portfolio, our investment returns could suffer. We must know the risks involved and select the proper investments for our time horizon and risk tolerance. Failing to take these two factors into account can lead to irrational behavior or withdraws from our investment portfolio at an inopportune time. Before you invest, make sure you know when you’ll need to withdraw your funds and how much volatility you can stomach.

Are you interested in getting one-on-one personalized advice on investing for the future? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.