Insurance is one of the few things in life that we pay for and hope to never use. We have auto insurance to protect our car, homeowners’ insurance to protect our homes, and we have life insurance to protect our… lives? Life insurance is different than other types of insurance because it actually isn’t about us at all. It’s about our partners, kids, families, and anyone else we deeply care about. We purchase life insurance to provide for the people we love and give them the lives they desire. If you have loved ones whom depend on you financially, you should ensure your life insurance coverage matches your needs and wishes.

What is Life Insurance?

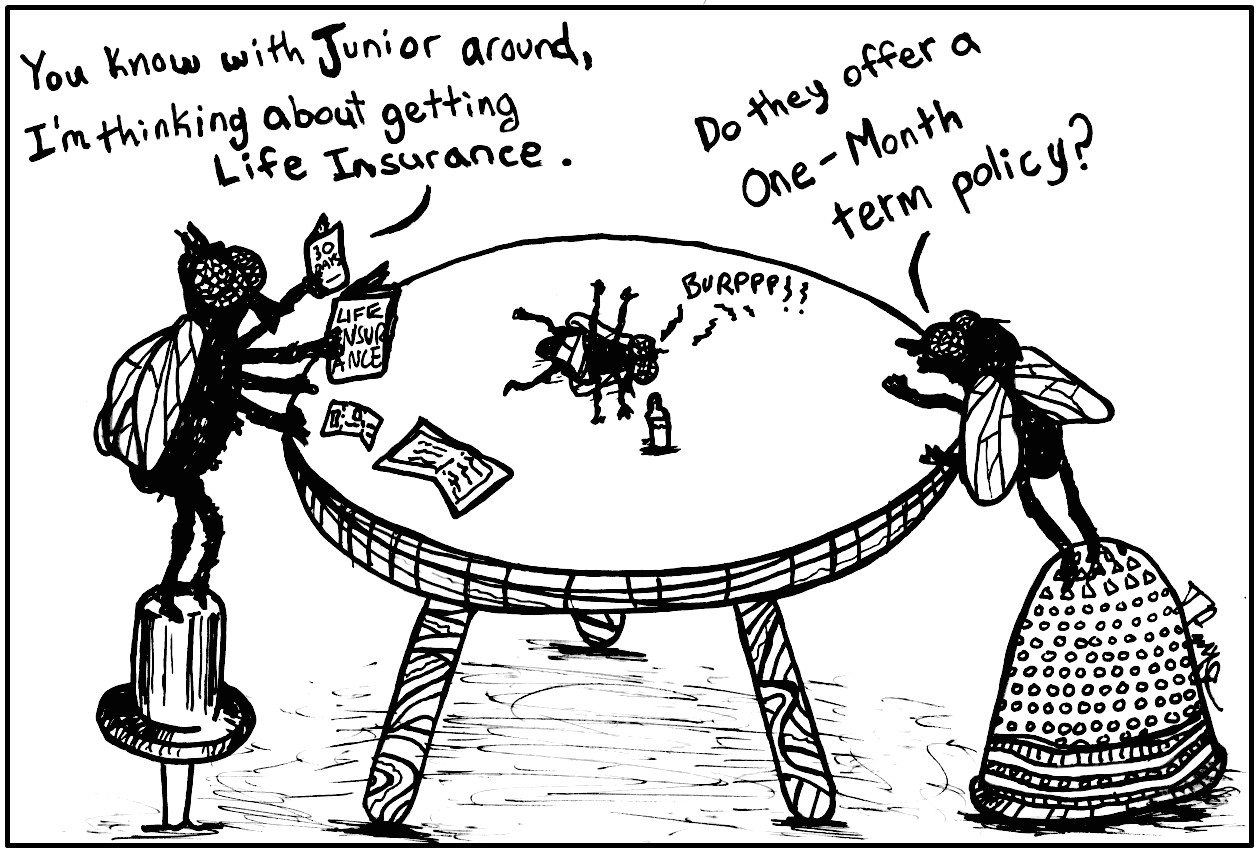

Life insurance pays out a predetermined amount of money at the insured person’s death (a death benefit) to people designated in the policy (beneficiaries). There are four main types of life insurance: term life, whole life, universal life, and variable universal life. However in this article we are only going to discuss term life because that’s the only type most people need.

Term Life Insurance is coverage for a predetermined period of time. It is the simplest and most affordable type of life insurance. As long as you pay the premiums (the cost of insurance), you’ll remain covered until the policy expires. For example, you may choose to have $200,000 of 10-year term life insurance. If you were to pass during the 10-year coverage period, your beneficiary would receive $200,000 from the insurance company.

The main difference between term life and other types of life insurance is that term life is focused. It’s designed to provide coverage for a set period of time and that’s it. Whole life, universal life, and variable universal life on the other hand, are often sold as “insurance and investments”. Instead of meeting one need, and meeting it well, they are overly complex, expensive and miss the mark on both objectives. Take caution before purchasing a life insurance policy other than term life, they are only necessary in certain situations.

Who Should Buy Life Insurance?

Life insurance is about financially caring for others after you’re gone. When a family member passes, the family’s income may be reduced (because there is one less paycheck) or their expenses may increase (because childcare is now necessary). Insurance is purchased to fill these gaps. Individuals with a high need for life insurance generally fall into one of the following categories:

People in Committed Relationships

Depending on how financially intertwined your life is with your partner, you may need life insurance coverage. Think of it in terms of income and expenses. If your paycheck stopped coming, would that create a financial hardship for your partner? As sad as it is, it’s not uncommon for families to be evicted from their homes if the primary earner passes without the proper insurance coverage. Try to identify areas that would create a hardship on your family. It could be mortgage payments, credit card debt, funeral expenses, or a number of other things.

Parents

Parents are keenly aware of their need for life insurance. Whether you’re a parent that works in a job full-time, takes care of the children full-time, or anywhere in between, you have a need for life insurance.

Primary income-earning parents: For the primary earner in the family, the proper coverage should at least replace their income, possibly for their entire estimated remaining career. For someone with 30 years until retirement, that might include enough coverage to allow their children to get through school and their spouse to reach retirement. Whatever the needs, no one wants their family to become a burden on others or to be impoverished.

Primary caregiving parents: Insurance is important for parents that have the primary role of caring for the children (part time or full time). Without their hard work, household expenses could increase dramatically and/or their responsibilities would fall on the surviving parent. With the average annual cost of daycare above $10,000, it could be a significant burden on a surviving parent with a single income and children to care for. Primary caregiving parents should consider coverage for the cost of daycare, as well as private school and college tuition.

Business Owners

Having a business can be like having a child. If you (as a business owner) were to pass, what would you want to happen? Would the business continue to operate or would it be dissolved and the assets sold off? If the business is a partnership, would the other partners buy your family out or vice versa? The answers to these questions can help you determine the coverage you’ll need.

If your business is indebted, you may want coverage up to the liabilities, so that your family doesn’t inherit debt. If you want the business to continue to operate, then you should ensure your family won’t need to liquidate it to cover their financial needs. If it’s a partnership, you should consider a buy-sell agreement backed with the proper amounts of life insurance coverage.

Who Doesn’t Need Life Insurance?

If your assets are greater than your debts and you don’t have any financial dependents, your need for life insurance could be very low. To determine your need, think about the ones you love and your desires for them after you’re gone. The average funeral costs $7,000. Do you want someone else to pick up the tab? Maybe you have elaborate plans for your funeral. It’s going to be a party and you want to fly in all of your old college buddies. If you have a dog, cat, or house pig, what will happen to them? Life insurance could make sure that your pet doesn’t become a financial burden to their future caregiver. These are the types of questions you need to ask to determine if you even need insurance.

How Much Life Insurance Do You Need?

As you can see the appropriate amount of life insurance is a complicated and highly personal decision. It’s not just a calculation based on your age, earnings, and household debt; it depends on your wishes for your family and loved ones.

Calculating Your Desired Coverage

There are two main ways to calculate your life insurance need: the net method and the simple method. The net method is comprehensive and complex. It estimates your family’s lifetime financial need and subtracts all of your potential income sources. The easiest way to estimate your need using the net method is to work with a professional or use an online calculator like this one provided by LifeHappens.org.

The simple method is not as thorough as the net method, but is useful because it provides a ballpark coverage figure. It’s called the simple method because you just add up the cost of all of your desires. Add up your mortgage, credit card debt, an estimate for daycare expenses, whatever it may be. This method doesn’t account for the fact that college savings will be invested and can grow until your children reach the right age, but gives you a general idea of your need.

Building a Term Life Ladder

Changes to your need for life insurance generally correspond to major life events (e.g. marriage, purchasing a home, paying off your home, having children, children graduating, retirement). This makes building a term life “ladder” an effective strategy. Use each life event as a signal to increase or decrease coverage.

For example: let’s say you desire that your mortgage be paid off completely in the event of your passing. For a $300,000 30-year mortgage you may take out three term life policies to create a “ladder”. Each policy would provide $100,000 of coverage with one being for 10 years, another for 20, and the final for 30 years. Your insurance coverage (and therefore the cost) would decrease automatically every ten years, corresponding with the mortgage being paid off. Effectively meeting your goal.

How to Get Life Insurance

Through Your Employer

If you are employed in a full-time salaried position you may already have life insurance. Many employers automatically provide annually renewable, term life insurance coverage equal to their employees’ annual salary. If your need for coverage is beyond this base amount, obtaining it through your (or your spouse’s) employer may be the best option.

Coverage through an employer is called group life insurance, because the insurance company groups you with your colleagues. This is generally the least expensive form of coverage, because it provides the insurance company with a guaranteed pool of applicants and allows them to provide discounted policies. You may be able to get hundreds of thousands of dollars of coverage for just a few dollars a month. Group life insurance is generally very affordable!

Through an Insurance Agent

If you’ve already maxed out coverage through your employer or are unable to obtain a group life policy, an insurance agent will gladly help you. However make sure you are aware of the conflicts of interest. Insurance agents are generally paid according to a commission structure, wherein selling greater levels of insurance and more expensive products rewards them financially. It’s in your best interest to seek advice from someone that doesn’t sell life insurance first, such as a fee-only financial adviser (shameless plug), then purchase the recommended policies from an agent.

Conclusion

Shopping for life insurance is not nearly as fun as picking out a car, home, or exotic pet. However, if you don’t obtain the proper coverage for your family, they may never be able to shop for anything again! Hopefully it would never be that bad, but you get the point. It’s not about you, it’s about them. For that reason no one can tell you how much coverage you’ll need, because it’s all about your desires for your family. Take time to have an open discussion with your partner, determine what’s most important, and calculate your need for coverage. Then try to secure it through an employer first, then through an agent. Insurance is something we never want to use, but will be one of our greatest regrets if we don’t have it.