Tis the season to don our tartan scarfs, cut an extra notch in our belts, and reach down into our hearts (and wallets) to give thanks. The holidays are a cheerful time that offers many opportunities to help others by volunteering and making charitable donations. Once the season passes and the cold hard reality of tax time hits in April, you’ll want to make sure you followed these rules to maximize your deductions.

#1 – Itemize Your Deductions

The term “tax deductible” gets thrown around a lot. Especially when it comes to charity. However, the truth is that just because something is “tax deductible” doesn’t mean that it will produce tax savings. The truth is that only 30% of taxpayers can receive any tax benefit from their charitable donations: those that itemize their deductions.

When you file your taxes you have two options: take the standard deduction or itemize qualifying expenses. The most common qualifying expenses for itemizing are mortgage interest, state income taxes, medical expenses, and charitable donations. For 2016, the standard deduction is $6,300 for a single taxpayer and $12,600 for a couple filing jointly. It would only be beneficial to itemize deductions if your qualifying expenses during the year add up to more than the standard deduction.

So who are the 30% of taxpayers that itemize and receive a benefit from their charity? For the most part, they are taxpayers that fall into one or both of the following categories.

Homeowners: Mortgage interest payments are an itemized deduction. A single taxpayer with a $200,000 mortgage at an interest of 4% will pay $8,000 ($200,000 X 4%) of interest in a year. Because this interest amount is greater than $6,300 (the standard deduction for a single taxpayer), it would be smart for this individual to itemize rather than take the standard deduction. The standard deduction is doubled for a couple filing jointly, however, therefore it would require a larger mortgage balance or a higher interest rate to beat the standard deduction.

State Income Tax: State income taxes are another large itemized deduction for many taxpayers. If you live in one of the 43 states with state income taxes, your payments may be sufficient to exceed the standard deduction. This is especially true if you have a high salary or live in a state with a high income tax rate (e.g. California, Oregon, Minnesota).

#2 – Ensure Your Donation Qualifies

For a donation to be tax deductible, it must meet both of the following criteria:

Made to a Qualified Organization: Qualified organizations are generally domestic organizations operated exclusively for a charitable, religious, educational, scientific, or literary purpose. You can’t deduct donations made to individual people.

Cash or Item in Good Condition: If your donation to a qualified organization is non-cash (e.g. clothing, household goods) the items must be in “good or better condition”. This means you can’t take a deduction for a broken computer or a puzzle that’s missing pieces.

#3 – Don’t Overestimate the Value

If you receive any goods or services (e.g. dinners, prizes, magazines) in exchange for your donation, you should reduce the value of your contribution. Oftentimes when this is the case, the organization will provide you with documentation that lists the net value of your contribution. This is the value you should use for your taxes.

When you are donating bags of clothing or household goods to Goodwill, the Salvation Army, or other organizations, you’ll generally have to estimate the value of your donation. It’s easy to overestimate the value of donated goods because we have certain attachments to them. It can be hard to fathom that the Abercrombie and Fitch jacket that you paid $199 for 10 years ago is only worth $5 today. You love it, but the IRS doesn’t. When it doubt, be conservative or use a pricing guide (like this one on Goodwill’s website). In case you are audited, you’ll want to have erred on the side of caution.

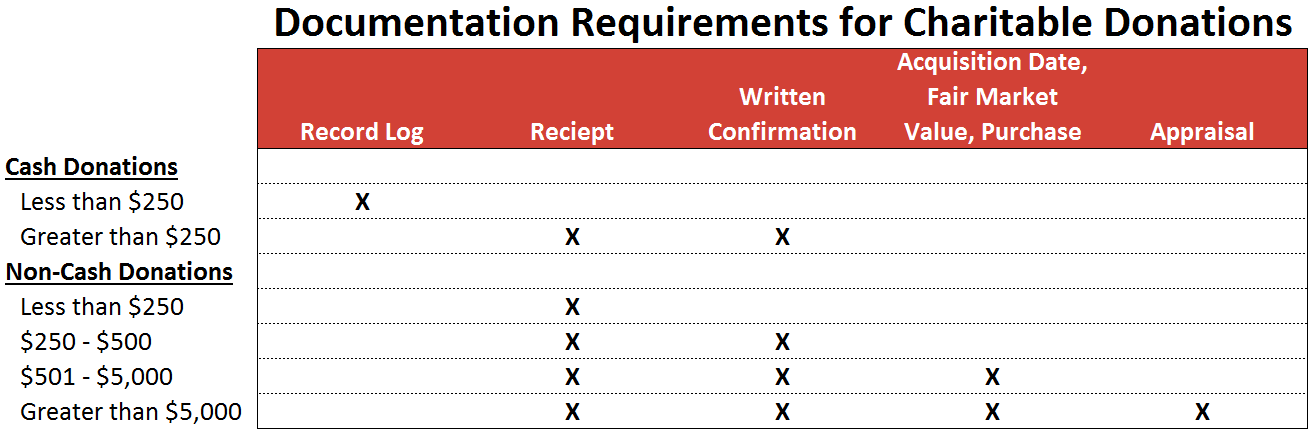

#4 – Maintain the Proper Documentation

Different donations require different documentation. Again, it’s best to be conservative and maintain any relevant documents. (I recommend scanning them and ditching the paper.) Generally you won’t need to file any of your records with the IRS, but if you’re audited you’ll be happy to have the records.A general rule of thumb is the larger the donation, the stricter the documentation requirements. Documentation guidelines are below, followed by a quick-reference chart you can refer back to.

Cash Donations of Less than $250: Single cash donations in this value range have the least stringent record keeping requirement. For example, if you give $20 to a Salvation Army representative outside of the grocery store, you won’t get a receipt. It’s up to you to track these donations. You should keep a log with the donation amount, date, location, and organization.

Non-Cash Donation of Less than $250: For the most part, this is where your donations of food, clothing, or household goods will fall. You are likely to receive a receipt, although the value of your donation won’t be assigned. I recommend making your estimation before you drop off your donation and writing it on the receipt immediately.

Cash Donations Greater than $250: In these cases, you’ll need to obtain written acknowledgement from the charity. The acknowledgement should confirm the date, amount, and whether any goods or services were received in exchange. Usually the charities will be prepared and send the acknowledgement automatically upon donation. If not, follow up.

Non-Cash Donations Between $250 and $500: Single non-cash donations within this value range require written acknowledgement from the charity, just as cash donations greater than $250 do.

Non-Cash Greater than $500 but Less than $5,000: Keeping accurate records of your non-cash donations can be very important if you are particularly charitable. If your total non-cash contributions in aggregate are greater than $500, you’ll be required to file Form 8283. This additional tax form requires you to know the address of the donee, the date you acquired the donated goods, the price you paid for them, and their fair market value on the date of donation. You’ll need this for each donation, not just the ones individually over $500.

Non-Cash Greater than $5,000: If you donated a single item valued at more than $5,000, checkout IRS Publication 561 to determine the necessary requirements. In short, an unbiased third party (neither you nor the receiving organization) will need to appraise the donated items.

#5 – Anticipate then Confirm the Value of Donated Vehicles

If you are donating a vehicle (e.g. car, boat, plane, swamp buggie) the amount of the deduction depends on how the charitable organization will be using it. If you are looking for the greatest deduction, you should take your time to understand the organization and what they plan to do with your vehicle.

For example, let’s take a donated car. If the organization sells your car, you’ll receive a deduction for the sale price. If they transfer ownership to a needy individual or use it for charitable purposes, you’ll receive a deduction for the fair market value. Because the donation value is dependent upon its use, the organization is required to provide Form 1098-C within 30 days of your donation. It’s your job to ensure you receive the form.

#6 – Don’t Forget Charitable Miles, Tolls, and Parking

If you volunteer for a qualified organization, you may be able to take a deduction for the miles you drive to, from, and during your volunteer time, and the tolls and parking expenses incurred. To be deductible the amounts must be unreimbursed, directly connected to the volunteer activity, incurred only because of the activity, and not personal in nature. For every mile that meets those criteria, you can deduct $0.14 (2016 figure). As with all charitable deductions, it’s important to maintain accurate records of the dates, locations, miles, and purpose for the deductions you are claiming.

#7 – Donate Appreciated Stock

If you’re looking to maximize your tax savings, donating appreciated stock is the way to go because of its double tax benefit. Consider two scenarios in which you own $1,000 of Facebook stock that you purchased two years ago for $500.

Scenario 1: You sell your Facebook stock for $1,000, pay a standard capital gains tax rate of 15% ($75), and donate the proceeds. The charitable organization receives a donation $925 that you can deduct on your taxes.

Scenario 2: You donate the Facebook stock itself, and the charitable organization sells it for $1,000 and pays no tax (because they are a tax-exempt charity). The charitable organization receives a donation of $1,000 that you can deduct on your taxes. Win-win!

Scenario two is clearly favorable for both you and the charity. Many churches and other qualified organizations are aware of this benefit and have systems in place to make stock donations easy. If you are making cash donations, consider using appreciated stock instead. There is one rule to keep in mind: only donate stock held for longer than one year. If you have held the stock for more than a year, you can deduct the fair market value. If you have held it for a year or less, you can only deduct the purchase price which will be lower, since the stock has appreciated in value.

#8 – Consider the Limit on Charitable Deductions

The IRS only allows you to claim a charitable deduction of up to 50% of your income (and in some cases less) in a single year. However, don’t let this dampen your charitability! If you are particularly charitable in a single year, you can still receive the full tax benefits. Any contributions you make that exceed the income limit can be deducted during the five succeeding tax years. The rules around this can be tricky, so ensure you have a plan to receive all of the deductions in which you are entitled.

Conclusion

For most of us, taxes are an afterthought to charitable giving and the tax savings are simply an added bonus. However, reducing our taxes by maximizing deductions can allow us to be even more charitable! Follow these 8 rules during your charitable giving this holiday season and your wallet will thank you come tax time.

Are you interested in getting one-on-one personalized advice on maximizing your tax deductions? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.

Very informative blog. Thanks for the Valuation Guide for Goodwill donations.

Thank you, Kevin! I’m glad you enjoyed it.